FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash, and the bonds will redeem in cash at maturity. The Bonds are issued by Reserve Bank on behalf of the Government of India.

Investors can buy these bonds through NSE/BSE at the issue price. The RBI announces a fresh sale. They are also available to buy and sell on NSE/BSE at the current price like any other security. Investors can redeem these bonds for cash upon maturity of the bonds or can sell it on NSE/BSE at current prices.

Sovereign Gold Bond is the "Best Gold Investment in India" because you will get the price appreciation benefit as well as 2.5% interest on your investment. When you purchase physical gold, you will get only price appreciation, not the annual interest.

From the year 2018, the maximum investment limit per financial year has increased from 500 gm to 4KG for individuals and HUF.

| Gold Bond Name | Subscription Date | Issue Date |

|---|---|---|

| SGB 2023-24 Series IV | Feb 12 to Feb-16, 2023 | Feb 21, 2023 |

| NSE Code | Gold Bond Name | Issue Date | Base Price | Retail Discount | Interest | Redemption | Performance Report |

|---|---|---|---|---|---|---|---|

| SGBFEB32VI | Sovereign Gold Bonds 2023-24-Series-IV | 21th Feb 2024 | ₹6263 | ₹50 | 2.50% PA | Feb-2032 | . |

| SGBDE31III | Sovereign Gold Bonds 2023-24-Series-III | 28th Dec 2023 | ₹6199 | ₹50 | 2.50% PA | Dec-2031 | Report |

| SGBSEP31II | Sovereign Gold Bonds 2023-24-Series-II | 20th Sep 2023 | ₹5923 | ₹50 | 2.50% PA | Sep-2031 | Report |

| SGBJUN31I | Sovereign Gold Bonds 2023-24-Series-I | 27th Jun 2023 | ₹5926 | ₹50 | 2.50% PA | June-2031 | Report |

| SGBMAR31IV | Sovereign Gold Bonds 2022-23-Series-IV | 06th Mar 2023 | ₹5611 | ₹50 | 2.50% PA | Mar-2031 | Report |

| SGBDE30III | Sovereign Gold Bonds 2022-23-Series-III | 19th Dec 2022 | ₹5409 | ₹50 | 2.50% PA | Dec-2030 | Report |

| SGBAUG30 | Sovereign Gold Bonds 2022-23-Series-II | 30th Aug 2022 | ₹5197 | ₹50 | 2.50% PA | Aug-2030 | Report |

| SGBJUN30I | Sovereign Gold Bonds 2022-23-Series-I | 28th Jun 2022 | ₹5091 | ₹50 | 2.50% PA | Jun-2030 | Report |

| SGBMAR30X | Sovereign Gold Bonds 2021-22-Series-X | 28th Feb 2022 | ₹5109 | ₹50 | 2.50% PA | Jan-2030 | Report |

| SGBJAN30IX | Sovereign Gold Bonds 2021-22-Series-IX | 18th Jan 2022 | ₹4786 | ₹50 | 2.50% PA | Jan-2030 | Report |

| SGBDS29VIII | Sovereign Gold Bonds 2021-22-Series-VIII | 27th Dec 2021 | ₹4791 | ₹50 | 2.50% PA | Dec-2029 | Report |

| SGBNV29VII | Sovereign Gold Bonds 2021-22-Series-VII | 02nd Nov 2021 | ₹4761 | ₹50 | 2.50% PA | Oct-2029 | Report |

| SGBSEP29VI | Sovereign Gold Bonds 2021-22-Series-VI | 07th Sep 2021 | ₹4732 | ₹50 | 2.50% PA | Sep-2029 | Report |

| SGBAUG29V | Sovereign Gold Bonds 2021-22-Series-V | 17th Aug 2021 | ₹4790 | ₹50 | 2.50% PA | Aug-2029 | Report |

| SGBJUL29IV | Sovereign Gold Bonds 2021-22-Series-IV | 12th July 2021 | ₹4807 | ₹50 | 2.50% PA | Jul-2029 | Report |

| SGBJU29III | Sovereign Gold Bonds 2021-22-Series-III | 08th June 2021 | ₹4889 | ₹50 | 2.50% PA | Jun-2029 | Report |

| SGBJUN29II | Sovereign Gold Bonds 2021-22-Series-II | 01st June 2021 | ₹4842 | ₹50 | 2.50% PA | Jun-2029 | Report |

| SGBMAY29I | Sovereign Gold Bonds 2021-22-Series-I | 25th May 2021 | ₹4777 | ₹50 | 2.50% PA | May-2029 | Report |

| SGBMAR29XII | Sovereign Gold Bonds 2020-21-Series-XII | 9th Mar 2021 | ₹4662 | ₹50 | 2.50% PA | Mar-2029 | Report |

| SGBFEB29XI | Sovereign Gold Bonds 2020-21-Series-XI | 9th Feb 2021 | ₹4912 | ₹50 | 2.50% PA | Feb-2029 | Report |

| SGBJAN29X | Sovereign Gold Bonds 2020-21-Series-X | 19th Jan 2021 | ₹5104 | ₹50 | 2.50% PA | Jan-2029 | Report |

| SGBJAN29IX | Sovereign Gold Bonds 2020-21-Series-IX | 5th Jan 2021 | ₹5000 | ₹50 | 2.50% PA | Jan-2029 | Report |

| SGBN28VIII | Sovereign Gold Bonds 2020-21-Series-VIII | 18th Nov 2020 | ₹5177 | ₹50 | 2.50% PA | Nov-2028 | Report |

| SGBOC28VII | Sovereign Gold Bonds 2020-21-Series-VII | 20th Oct 2020 | ₹5051 | ₹50 | 2.50% PA | OCT-2028 | Report |

| SGBSEP28VI | Sovereign Gold Bonds 2020-21-Series-VI | 8th Sep 2020 | ₹5117 | ₹50 | 2.50% PA | SEP-2028 | Report |

| SGBAUG28V | Sovereign Gold Bonds 2020-21-Series-V | 11th Aug 2020 | ₹5334 | ₹50 | 2.50% PA | Aug-2028 | Report |

| SGBJUL28IV | Sovereign Gold Bonds 2020-21-Series-IV | 14th Jul 2020 | ₹4852 | ₹50 | 2.50% PA | Jul-2028 | Report |

| SGBJUN28 | Sovereign Gold Bonds 2020-21-Series-III | 16th Jun 2020 | ₹4677 | ₹50 | 2.50% PA | Jun-2028 | Report |

| SGBMAY28 | Sovereign Gold Bonds 2020-21-Series-II | 22nd May 2020 | ₹4590 | ₹50 | 2.50% PA | May-2028 | Report |

| SGBAPR28I | Sovereign Gold Bonds 2020-21-Series-I | 28th Apr 2020 | ₹4639 | ₹50 | 2.50% PA | Apr-2028 | Report |

| SGBMAR28X | Sovereign Gold Bonds 2019-20-Series-X | 11th Mar 2020 | ₹4260 | ₹50 | 2.50% PA | Mar-2028 | Report |

| SGBFEB28IX | Sovereign Gold Bonds 2019-20-Series-IX | 11th Feb 2020 | ₹4070 | ₹50 | 2.50% PA | Feb-2028 | Report |

| SGBJ28VIII | Sovereign Gold Bonds 2019-20-Series-VIII | 21st Jan 2020 | ₹4016 | ₹50 | 2.50% PA | Jan-2028 | Report |

| SGBDC27VII | Sovereign Gold Bonds 2019-20-Series-VII | 10th Dec 2019 | ₹3795 | ₹50 | 2.50% PA | Dec-2027 | Report |

| SGBOCT27VI | Sovereign Gold Bonds 2019-20-Series-VI | 30th Oct 2019 | ₹3835 | ₹50 | 2.50% PA | Oct-2027 | Report |

| SGBOCT27 | Sovereign Gold Bonds 2019-20-Series-V | 15th Oct 2019 | ₹3788 | ₹50 | 2.50% PA | Oct-2027 | Report |

| SGBSEP27 | Sovereign Gold Bonds 2019-20-Series-IV | 17th Sep 2019 | ₹3890 | ₹50 | 2.50% PA | Sep-2027 | Report |

| SGBAUG27 | Sovereign Gold Bonds 2019-20-Series-III | 14th Aug 2019 | ₹3499 | ₹50 | 2.50% PA | Aug-2027 | Report |

| SGBJUL27 | Sovereign Gold Bonds 2019-20-Series-II | 16th Jul 2019 | ₹3443 | ₹50 | 2.50% PA | Jul-2027 | Report |

| SGBJUN27 | Sovereign Gold Bonds 2019-20-Series-I | 11th Jun 2019 | ₹3196 | ₹50 | 2.50% PA | Jun-2027 | Report |

| SGBFEB27 | Sovereign Gold Bonds 2018-19-Series-VI | 12th Feb 2019 | ₹3326 | ₹50 | 2.50% PA | Feb-2027 | Report |

| SGBJAN27 | Sovereign Gold Bonds 2018-19-Series-V | 22nd Jan 2019 | ₹3214 | ₹50 | 2.50% PA | Jan-2027 | Report |

| SGBDEC26 | Sovereign Gold Bonds 2018-19-Series-IV | 1st Jan 2019 | ₹3119 | ₹50 | 2.50% PA | Jan-2027 | Report |

| SGBNOV26 | Sovereign Gold Bonds 2018-19-Series-III | 13th Nov 2018 | ₹3183 | ₹50 | 2.50% PA | Nov-2026 | Report |

| SGBOCT26 | Sovereign Gold Bonds 2018-19-Series-II | 23rd Oct 2018 | ₹3146 | ₹50 | 2.50% PA | Oct-2026 | Report |

| SGBMAY26 | Sovereign Gold Bonds 2018-19-Series-I | 4th May 2018 | ₹3114 | ₹50 | 2.50% PA | May-2026 | Report |

| SGBJAN26 | Sovereign Gold Bonds 2017-18-Series-XIV | 1st Jan 2017 | ₹2881 | ₹50 | 2.50% PA | Jan-2026 | Report |

| SGBDEC2513 | Sovereign Gold Bonds 2017-18-Series-XIII | 26th Dec 2017 | ₹2866 | ₹50 | 2.50% PA | Dec-2025 | Report |

| SGBDEC2512 | Sovereign Gold Bonds 2017-18-Series-XII | 18th Dec 2017 | ₹2890 | ₹50 | 2.50% PA | Dec-2025 | Report |

| SGBDEC25XI | Sovereign Gold Bonds 2017-18-Series-XI | 11th Dec 2017 | ₹2952 | ₹50 | 2.50% PA | Dec-2025 | Report |

| SGBDEC25 | Sovereign Gold Bonds 2017-18-Series-X | 4th Dec 2017 | ₹2961 | ₹50 | 2.50% PA | Dec-2025 | Report |

| SGBNOV25IX | Sovereign Gold Bonds 2017-18-Series-IX | 27th Nov 2017 | ₹2964 | ₹50 | 2.50% PA | Nov-2025 | Report |

| SGBNOV258 | Sovereign Gold Bonds 2017-18-Series-VIII | 20th Nov 2017 | ₹2961 | ₹50 | 2.50% PA | Nov-2025 | Report |

| SGBNOV25 | Sovereign Gold Bonds 2017-18-Series-VII | 13th Nov 2017 | ₹2934 | ₹50 | 2.50% PA | Nov-2025 | Report |

| SGBNOV25VI | Sovereign Gold Bonds 2017-18-Series-VI | 6th Nov 2017 | ₹2945 | ₹50 | 2.50% PA | Nov-2025 | Report |

| SGBOCT25V | Sovereign Gold Bonds 2017-18-Series-V | 30th Oct 2017 | ₹2971 | ₹50 | 2.50% PA | Oct-2025 | Report |

| SGBOCT25IV | Sovereign Gold Bonds 2017-18-Series-IV | 23rd Oct 2017 | ₹2987 | ₹50 | 2.50% PA | Oct-2025 | Report |

| SGBOCT25 | Sovereign Gold Bonds 2017-18-Series-III | 16th Oct 2017 | ₹2956 | ₹50 | 2.50% PA | Oct-2025 | Report |

| SGBJUL25 | Sovereign Gold Bonds 2017-18-Series-II | 28th Jul 2017 | ₹2830 | ₹50 | 2.50% PA | Jul-2025 | Report |

| SGBMAY25 | Sovereign Gold Bonds 2017-18-Series-I | 12th May 2017 | ₹2951 | ₹50 | 2.50% PA | May-2025 | Report |

| SGBMAR25 | Sovereign Gold Bonds-2016-17-Series-IV | 17th Mar 2017 | ₹2943 | ₹50 | 2.50% PA | Mar-2025 | Report |

| SGBNOV24 | Sovereign Gold Bonds-2016-17-Series-III | 17th Nov 2016 | ₹3007 | ₹50 | 2.50% PA | Nov-2024 | Report |

| SGBSEP24 | Sovereign Gold Bonds-2016-17-Series-II | 23rd Sep 2016 | ₹3150 | ₹0 | 2.75% PA | Sep-2024 | Report |

| SGBAUG24 | Sovereign Gold Bonds-2016-17-Series-I | 5th Aug 2016 | ₹3119 | ₹0 | 2.75% PA | Aug-2024 | Report |

| SGBMAR24 | Sovereign Gold Bonds-2016-Series-II | 29th Mar 2016 | ₹2916 | ₹0 | 2.75% PA | Mar-2024 | Report |

| SGBFEB24 | Sovereign Gold Bonds-2016-Series-I | 8th Feb 2016 | ₹2600 | ₹0 | 2.75% PA | Feb-2024 | Report |

| SGBNOV23 | Sovereign Gold Bonds-2015-Series-I | 26th Nov 2015 | ₹2684 | ₹0 | 2.75% PA | Nov-2023 | Report |

Sovereign Gold Bond - RBI Press Releases

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

Investors are going to get 2.50% per annum (Fixed rate) interest on the initial investment. Interest will credited semi-annually to the bank account of the investor. The last interest will be payable on maturity along with the principal. In such case if you are planning to buy physical gold for investment, this bond is giving same advantage + extra interest of 2.50% PA. As well as you can use this bound for collateral for loans.

In this section we have included complete comparison guide in table format for gold investment. With this we can conclude buying SGB is the best investment options compare to gold ETF and physical gold as you get all the advantages from both the options + additional 2.5% interest income on your investment. You can use SGB for Collateral against Loan also.

| Points | Physical Gold | Gold ETF | Sovereign Gold Bond |

|---|---|---|---|

| Returns | Lower than actual return on gold | Lower than actual return on gold | Higher than actual return on gold |

| Extra Returns | No | No | Interest of 2.5% on the initial investment |

| Safety | Risk of handling physical gold | High | High |

| Maximum Quantity | No Limit | No Limit | 4 kg for individual, 4 kg for HUF, and 20 kg for trusts and similar entities per fiscal (April-March). |

| Purity of Gold | Purity of Gold always remains a question | High as it is in Electronic Form | High as it is in Electronic Form |

| Capital Gain | Long term capital gain applicable after 3 years | Long term capital gain applicable after 3 years | Long term capital gain applicable after 3 years. ( No Capital gain tax if held till maturity ) |

| Collateral against Loan | Yes | No | Yes |

| Tradability / Exit Route | Conditional | Tradable on Exchange | Tradable on Exchange. Redemption- 5th year onwards with GoI |

| Storage Cost | High | Very Low | Very Low |

Investors can buy/apply for the bond through SEBI authorized trading members and financial advisors of NSE, BSE. The RBI also appointed scheduled commercial banks and designated post offices. NBFCs, National Saving Certificate (NSC) agents and others can act as agents. They would authorized to collect the application form and submit in banks and post offices. Application forms will be provided by trading members, authorized agents and can also be downloaded from RBI's website.

The Bonds are issued by the Reserve Bank of India on behalf of the Government of India. The bonds are distributed through banks and designated post offices, NSE and BSE. This should make subscribing to the bonds an easy affair. During redemption, "the price of gold may be taken from the reference rate, as decided, and the Rupee equivalent amount may be converted at the RBI Reference rate on issue and redemption".

Yes, there may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold that he has paid for. Investor are going to get 2.50% interest PA on investment, which is apart from gold price movement.

Persons resident in India as defined under the Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities, charitable institutions, etc.

Yes. Bond can be bought on the name of the minor, the application on behalf of the minor has to be made by his / her guardian.

Minimum 1 gram and maximum 4KG per person per fiscal year (April - March). From Oct 2017, you can subscribe 4 KG for individual, 4 Kg for HUF per fiscal year. This 4 KG includes both initial issuance of Government and those purchased from the Secondary Market.

Yes, If the customer meets the eligibility criteria, produces a valid identification document and remits the application money on time, he/she will receive the allotment.

Yes, A customer can apply online through the website of the listed scheduled commercial banks, NSE, BSE or SEBI registered brokers.

The investor will advise one month before maturity on the ensuing maturity of the bond. On the date of maturity, the maturity proceeds will credit to the bank account as per the details on record. In case there are changes in any details, such as, account number, email ids, then the investor must intimate the bank/PO promptly.

Yes, these securities are eligible to use as collateral for loans from banks, financial Institutions and Non-Banking Financial Companies (NBFC). The Loan to value ratio will be the same as applicable to ordinary gold loan mandated by the RBI from time to time.

The bonds are tradable on stock exchanges from the date to be notified by RBI. The bonds can also be sold and transferred as per provisions of the Government Securities Act.

Yes, buying sovereign gold bonds online is the best and easy option. As per RBI guidelines, banks/SHCIL offices/designated Post Offices/agents are the issuing agencies for sovereign gold bonds.

Most of the banks allow you to buy/invest in sovereign gold bonds online with their net banking platform. However, the banks who are providing 3-in-1 accounts (savings account, Trading account, and Demat account) offer direct links to buy SGB from their trading application.

As you have a Demat account linked with your 3 in 1 account, you will get the Demat holding of your SGB once issued.

In case you don’t have a 3-in-1 account with a bank, you can still purchase/invest in sovereign gold bonds by submitting your application online via net banking. If you don’t have net banking access, you can visit a nearby bank or post office and fill the application offline.

When you submit an application offline, you will not get an online discount ofRs 50 per gram.

For an offline application, you can apply up to Rs 20,000 by cash. For above Rs 20,000, you need to transact via cheques/demand draft/electronic fund transfer.

If you have a trading and Demat account with any broker then you can buy/invest in sovereign gold bonds online. You will get Rs 50 per gram discount as you are buying SGB online as well as you will get an issued bond in your demat account. In case you want to liquidate your holding any time, you can sell the same in the stock market.

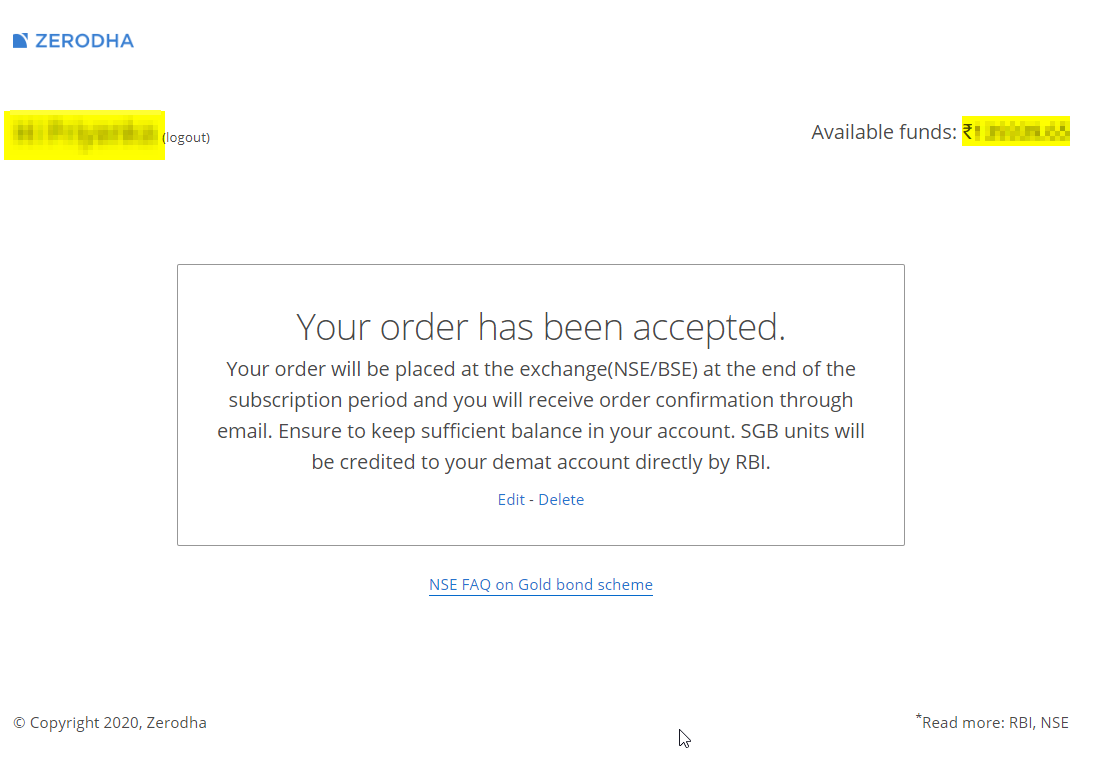

Yes, Zerodha allows you to invest in Sovereign Gold Bonds online. Zerodha has created a special page for the same. Link will be active only when there are active Sovereign Gold Bonds Schemas. Orders are accepted till 3:30 PM on the last subscription date.

Sovereign Gold Bonds are listed on the exchange 10-15 days after the issue date and can be traded on Zerodha Kite. For now, SGBs are traded via CNC orders only.

You can buy SGB (Sovereign Gold Bond) from banks and other financial intermediaries or directly from the broker.

When you buy SGB from any financial institute then it is always preferable to mention your Demat account information, so that, you hold SGB in your Demat account and can be traded on NSE like stocks. In that case, you don’t have any locking period. However, if you have not provided Demat information to the concerned bank then you hold a physical certificate for your SGB holdings.

To sell SGB (before maturity), SGB must be converted into dematerialized form. So if you want to sell SGB before maturity but have not yet converted bonds into Demat form then firstly, you have to provide your Demat account details to the concerned bank, so that, the bank will upload the details on the e-Kuber portal of RBI to process dematerialization request.

To provide your Demat details, you must get CMR (Client Master Report) from the respective broker. The CMR contains your Demat account details including name, DOB, nominee, bank account, etc.

Once the concerned bank has mapped your Demat details and SGB is successfully credited to your Demat account. Then you can easily sell it on the NSE by placing a regular sell order just like stocks.