FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

This is a very basic question asked by many users. To apply in the buyback, you must have holding of scripts on the record date. If you wish, you can sell your script (optional) after the buyback record date and buy it again just before the buyback opens and tender your shares for a buyback. Usually, there are 1 to 2 months of processing time between the record date and buyback close date. So you don’t need to block your money for 2 months in case you are a retail trader.

Before buyback window opens, Registrar sends Letter of Offer and Tender Form (“personalized Form of Acceptance-cum-Acknowledgement”) via email or in a physical format at your registered address. The Letter of Offer and Tender Form are being sent to you as a registered equity shareholder of the Company as on the Record Date.

Now answering the question- how to apply/participate in buyback with Zerodha:

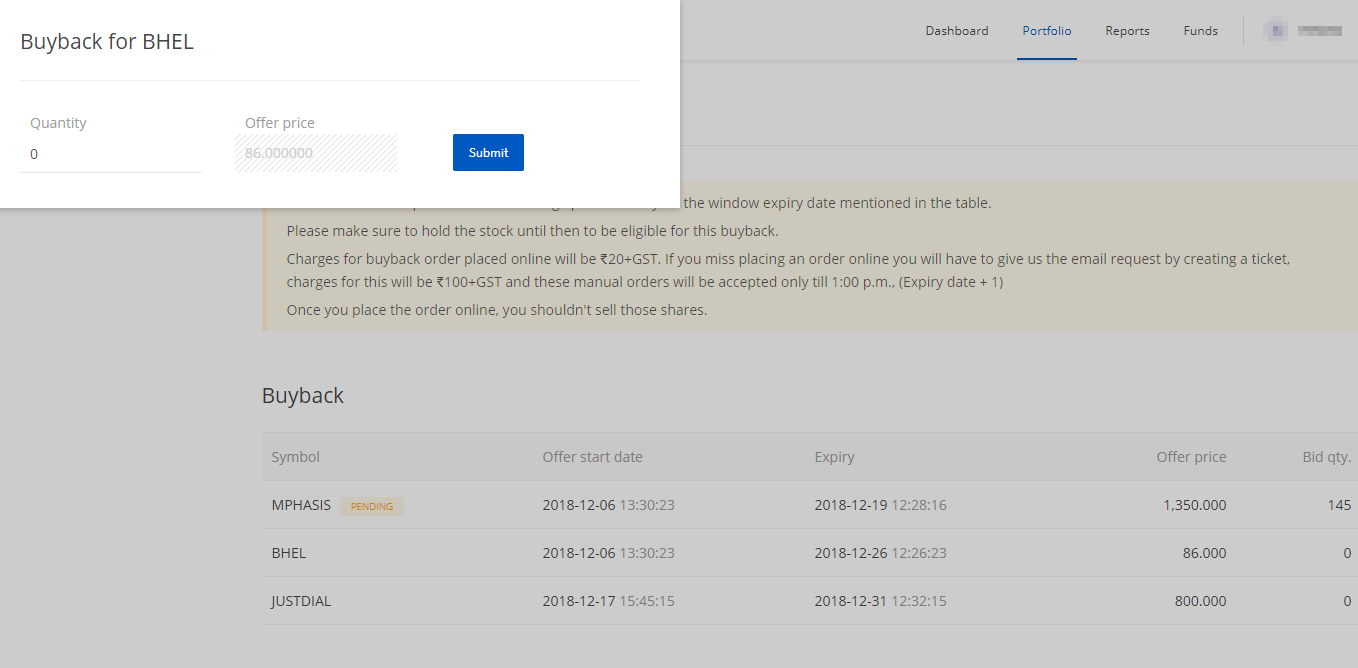

Brokerage firms like ICICIDirect, HDFC Securities has an option in IPO Section, where you can tender your holdings in buyback online. Zerodha also providing online option for tendering your buyback scripts on your convenience. You can do buyback tender of shares with Zerodha online in a less than 30 second.

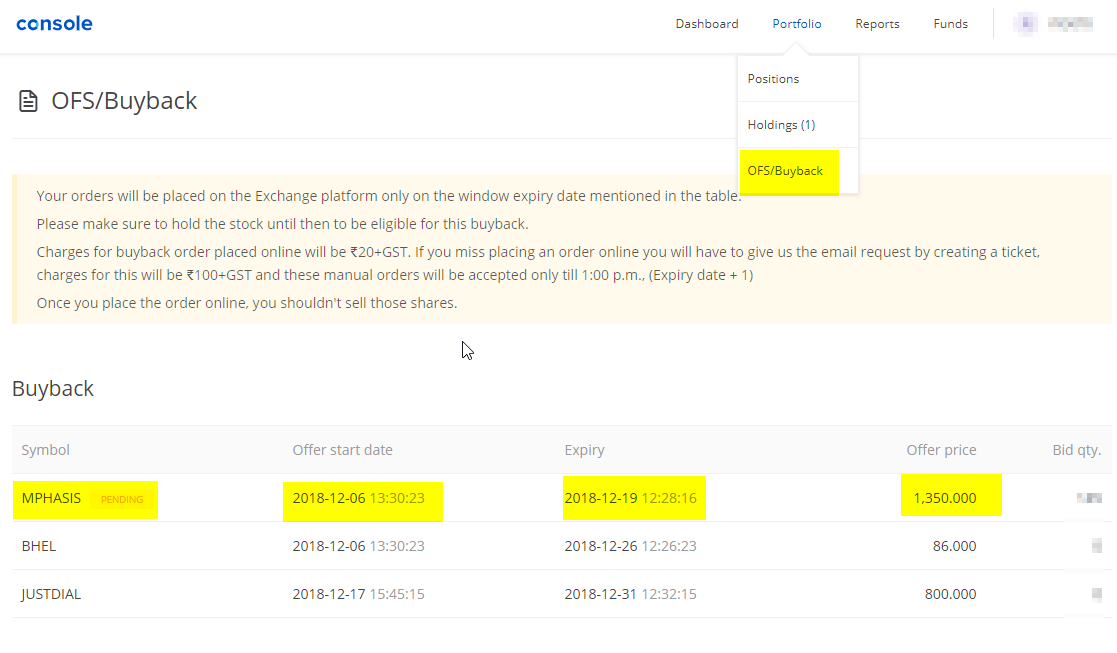

1:Login to console.zerodha.com with your kite login id.

2:Send an email to Email with the following detail – (Option Closing on 20th Dec 2018), After that no more manual orders will be accepted.

3:Fill Physical Tender Form and submit to your nearest branch office or courier to Zerodha Sales office. – Not applicable, as Zerodha has provided a online submission process.

The broker will consolidate all Buyback request and send to exchange on a regular interval. When you are applying for the buyback, you must have held of scripts in your demat account. You need to plan in advance if you have sold the script after the record date.

We personally suggest to tender all equity shares (complete holding of the script as of Record Date) since the actual acceptance ratio can be higher from proposed acceptance ratio in Tender Form.

For example – Record date for XYZ share buyback is Jan 30, 2017. So one must have stocks in demat account on or before 30th Jan 2017. For that, you need to buy a script by 28th Jan 2017 considering there are no settlement holidays. Usually, there are T+ 2 days of settlement window, so you must have plan accordingly.

Once you have holding on the record date, to declare buyback open and end date this process takes 4 to 6 week and you will get 2 weeks of buyback window, so after 30th Jan 2018 you can sell your scripts (optional) in case you don’t want to lock your money for approx 2 months. Once buyback window dates announce you can again accumulate the shares and apply for buyback.

Assume XYZ Company announces buyback open and close date as 10th March 2017 to 25th March 2017. You can apply in buyback in this window any time by sending an email to Zerodha support team.

Zerodha Trade@20

List of all questions Ask your question