FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

Zerodha, India's largest discount broker launched Kite, a super fast and super easy online trading platform in 2015. Kite by Zerodha is a flagship trading platform based on HTML5 technology, available in web and mobile app versions. Whether you are a beginner or an expert, Kite has almost every feature you need. The platform is free for all users and allows trading across multiple exchanges including BSE, NSE, and MCX.

Kite Zerodha has many powerful features, including advanced charts, live streaming of market data, multiple chart views, advanced orders, a clean and elegant user interface, and can even work with lower internet bandwidth. The platform combines speed and simplicity which make the Kite app one of the top-rated and best trading platforms in India.

Learn more about Zerodha Kite, including Kite app features, charges, how to add or withdraw money from Kite, types of charts available, and more.

Kite 3.0 is an HTML 5 based online trading platform to trade in equity, derivatives, commodities, and currencies. The ultra-light, user-friendly, and multiple functionality-rich Kite platform is available in the browser-compatible website and mobile app versions.

Kite Web |

Kite web is a browser-compatible web trading platform that can be used across any browser such as Firefox, Chrome, Internet Explorer, etc. In 2017, Zerodha launched the latest version Kite 3.0 beta. kite.zerodha.com comes with features i.e. multiple order placement, a universal search bar, charting tool, live market data, and many more. |

Kite Mobile App |

The mobile app version of the Kite platform was first time launched in 2019. Kite app (Android and iOS) is one of the fastest and the most powerful trading app to trade at your fingertips. Intuitive dashboard, advanced charting, view positions & holdings, funds transfer, multiple market watchlists, etc. are the basic features of the Kite Mobile App. |

Kite Connect API |

Kite API is a set of HTTP/JSON API, any Zerodha client can get the API, change the coding, and create their own front-end full-fledged trading platform.

|

Kite platform is one of India's best trading platforms due to its exceptional range of features like powerful charting, multiple market watchlists, hassle-free fund transfer, trade from the chart, and others. Here are the details;

Kite is a multilingual app in over 10 different languages to enable users to access the platform in their local language.

The Kite platform allows online trading in equity, derivative, commodity, and currency segments at BSE, NSE, and MCX.

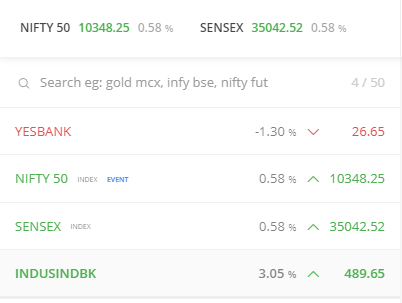

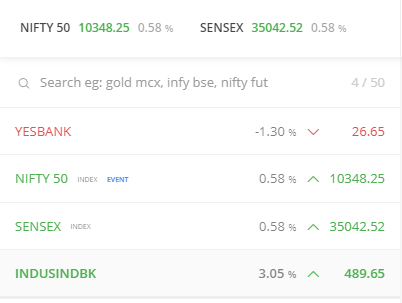

Kite has a single search bar to search different instruments whether stocks, equity F&O contracts, and commodity derivative contracts on MCX.

You can create upto 7 watchlists on Kite and add upto 50 scrips in each watchlist to track your favorite stock price movement.

Kite is able to work on very low internet bandwidth of even less than 0.5 kbps. It is especially a great feature for users in small towns with poor internet connectivity.

All the scrips added to the watchlists provides exclusive access to 3-level data (Orders, quantity, and price) for both the buy and sell offer with 20 market depth that is useful to check liquidity.

Kite offers the most powerful charting feature with 6 different types of charts, 100+ technical indicators, 20+ drawing tools, multiple chart view features, multiple chart timeframes, and others.

Zerodha Kite’s “Add Funds” Interface facilitates customers to add funds through various options like Unified Payment Interface (UPI), payment gateway (25+ banks), and IMPS/RTGS/NEFT.

You can place orders directly through the chart and drags the order window up or down to set the order price. The feature is currently available on the Kite web platform.

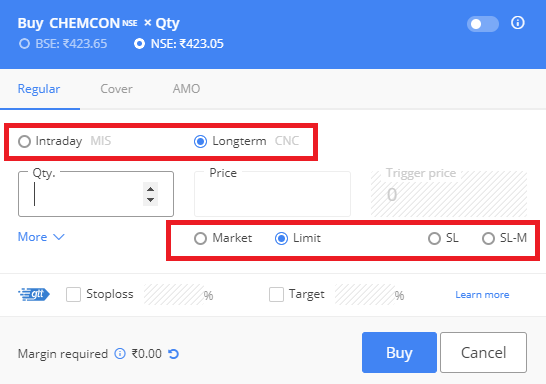

Customers can place different types of orders i.e. MIS (Margin Intra-day square off), CNC (Cash N Carry), NRML, Stop loss, Stop loss-market, etc. They can also place advanced orders like After market order, Cover Order (CO), and Good Till Triggered (GTT) on Kite.

Zerodha Kite is an easy-to-use platform with intuitive dashboard and user-friendly interface.

Track your investment portfolio anytime under the “Holdings†tab. However, all intraday trades are visible in the “Positions†tab. You can also check order history including orders placed, orders executed, and pending orders.

Zerodha allows customers to place GTT order. GTT is a special order to enable customers to set a trigger price for a stock, once the scrip reaches that level, then the limit order will be placed automatically on the exchange.

GTT order in Zerodha is free at no additional charges, and the order remains valid for 365 days or 1 year.

You can use ample of shortcut keys to access Kite features instantly by just pressing a key. The keyboard shortcuts are extremely useful to place instant buy and sell orders, access charts, etc.

Nil, Kite is an absolutely free trading platform by Zerodha that is available at zero charges. Customers can access the Kite Web and the mobile app on Android and iOS devices for free at 0 fees.

You can add or transfer funds to the Zerodha trading account using multiple modes be it UPI or Net Banking. UPI is the free method to add money instantly to your Zerodha account.

Know more about Zerodha Fund Transfer Review >>> Click Here

Zerodha offers both intraday (MIS) as well as delivery (CNC) trading, and a client can place various types of orders under both segments. Here are the Kite product and order types explained;

| Products/Orders | Description |

|---|---|

| MIS Order | You can start intraday trading by placing an MIS (Margin intraday square-off) order, in which, you must close your positions the same trading session, and otherwise, Zerodha itself close your position at intraday square off charges of Rs. 50 + GST. |

| CNC Order | CNC orders are used for delivery trading hence, require 100% margin upfront in your trading account. Stocks bought on CNC will be transferred to your Demat account as per the T+2 period. Zerodha offers free equity delivery trading at zero brokerage. |

| Market order | Buy or sell order placed at the prevailing market price of a scrip. |

| Limit order | Buy or sell orders that are placed at a specific target price are called limit orders. |

| Stop loss order (SL) | A stop-loss is a limit order to stop losses whenever the stock price level reaches a certain level, then the order will be placed at the specified price automatically on the exchange. |

| Stop-loss market (SL-M) | This type of order is placed at the market price at the exchange, once the stock reaches the trigger price. |

| Regular (NRML) | These are normal F&O orders that are held until the expiry period. |

Zerodha provides a Kite user manual to enable users to examine how to access different features on Kite.

| Pros/Advantages | Cons/Disadvantages |

|---|---|

Kite is a modern, sleek, and feature-loaded web and app-based platform. It has all the necessary features for both beginners and professional traders.

Simplicity, ease of use, intuitive dashboard, hassle-free money transfer and one-tap order placement are the features for investors. Multiple types of charts, trading directly from the chart, hundreds of technical indicators, and drawing tools are some of the interesting features for traders to perform technical analysis. All these features provide an effortless trading and investing experience for everyone.

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

As of now, it can be accessed on Kite web and not on Kite mobile. It is only available for NSE scripts. It is only available to Zerodha's active trading clients those who have generated over Rs 100 brokerage in the last 4 weeks. It is now available for free but later it will be charged.

Steps to add funds with Zerodha

Stoploss order (SL) is an important order type allowed on Zerodha kite to facility traders to limit their losses.

Steps to place Stoploss order on Kite

Zerodha Kite Tutorial or kite user manual is available on the broker’s website. The manual guide Zerodha users about how to use the Kite trading platform to place orders, view portfolio holdings, buy and sell various stocks, and others.

Steps to get Kite User Manual

The default settings on Kite presents ChartIQ charts thus, if any Zerodha user wants to view TradingView charts then follow these steps;

No, Kite connect by Zerodha is not a free service as the discount broker levies a subscription fee of Rs. 2000 every month to enable users to customize the platform and design user interface as per their convenience.

Zerodha Kite is a web and app-based trading platform, to login with Zerodha kite mobile app, follow these steps;

Recently, on 10th June 2020, Zerodha has launched a new feature through where you can know margins directly when you’re placing an order on Kite Web. Thus, users no more need to use the margin calculator to figure out your margin required. The margins will be shown on the Zerodha Kite order window.

For instance, if you’ve placed a buy order for IndusInd Bank, then in the order window on Kite, you can check margins in the yellow highlighted part.

After entering the quantity, you can click on the refresh icon on the margins required section to know the total margins. Currently, the feature is only available on Kite Web and not yet available on Kite mobile app.

Kite API provides access to the building interface of Kite and enables users to create their own front-end trading platform. The API is only available to Zerodha customers means one who has opened Zerodha Demat and Trading account.

Steps to access Zerodha Kite API:

3 rd class share broker name zerodha..... koi bhi account mat khulvana...... jab bhi market volatile hoga apka trade hi nahi hoga... or aap phone kar ke thak jaoge lekin zerodha vale fone nahi uthaenge... or agar galti se utha liya to bolega isme me kya karu ... ye aapki galati hai jo apne account zerodha me khulavaya.