FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

Mutual Fund Investing-Direct Plan or Regular Plan, Which plan to be choose? Advantage of Direct Plan.Ways to invest in Direct Plan

Investment is a big decision for any investor as it involves their hard earned money. With the popularity of mutual funds, it’s not only important to choose the correct scheme but also to choose the correct plan.

Before choosing which plan is good for you, it’s imperative to learn about the available plans and the difference between them so as to decide which suits you better and why?

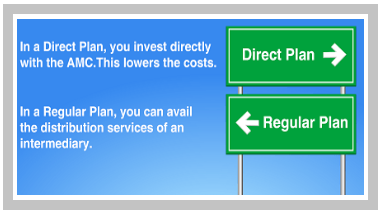

An investor can either invest directly without involving any Mutual Fund distributor or agent in a DIRECT PLAN or with the help of a financial intermediary in REGULAR PLAN. The schemes under both the plans have the same portfolio but different Expense Ratio (recurring expenses in every mutual fund scheme)

Investing in Direct Plan is similar to buying products from the manufacturer directly without involving any intermediary and it’s quite understandable to see the price difference between the two because of the elimination of middle levels.

Direct Plan tends to have lower expense ratio than the Regular Plan, as there is no agent involved, and hence there is saving in terms of commissions paid out to the agent, which is added back to the returns of the scheme. This little savings keeps on adding year on year and thereby Direct Plan has a separate NAV, which is higher than the normal “Regular” Plan’s NAV. Thus, the investment in Direct Plan would be worth more over a period, in comparison to investment in Regular Plan of the same scheme. However, the difference between the NAV’s of Direct Plan and Regular Plan is not significant enough to make much difference.

Apart from the financial differences stated above, there are some non-financial factors as well that needs consideration before deciding on the plan.

In General, Direct Plan is suited for individuals who possess knowledge about mutual funds and are capable of researching about the schemes himself and later able to make an informed decision on investing as per their investment needs. Since there is no agent or distributor involved in the Direct Plan to guide the way, the investor has to himself weigh all the risks and rewards associated with the investing. As an investor, you are not only concerned about deciding where to invest but to keep eye on the investment as and when the market conditions changes either favorably or unfavorably. Said that Direct Plan makes sense for experienced and knowledgeable investors. So if you are a new and inexperienced investor or unsure in which scheme to place your bet on and need guidance with investing, you better take help of a mutual fund distributor and invest in a Regular Plan.

Invest in Mutual Fund via Direct Plan, We can help you choose the right broker. Contact us today...

Investing in Direct Mutual Fund Plans is allowed to all, you don’t need any special account. Only thing which you need to do is your own analysis. When you chose to invest in direct plan, you need to bypass your middle man or broker or agent.

Free investment platform for Direct Mutual Fund investment are -

To Open account with AMC, you need PAN card, Aadhar Card and a bank account. KYC process need to be complete, which can be done via your Aadhar number.

Yes, Zerodha Coin is free Mobile App and you can invest in mutual funds if you have trading and demat account with Zerodha. To invest in Mutual fund with Zerodha, Zerodha Demat account is mandatory.

When you do investment via AMC, you don’t need Demat account, but if you wish to do investment via broker/distributor, yes you need demat account.

Yes, You can switch from regular to direct mutual fund plan , but you may pay to early exit fee if applicable, you need to take care of tax liabilities – short term vs long term capital gain. This transaction can be done directly via AMC online portal. The online form asks for the scheme name, folio number and holder details. It can also be done through CAMS, Karvy, MF Utility or through Sebi RIAs.

The best option we can suggest you is you can hold your existing investment to complete cooling off period with regular schema, start your new investment with Direct Mutual funds, and on maturity or completion of cooling off time, you can request to move your existing schema to direct plan. In case of SIP investment, it’s better to move to direct plan for your new investment, so you can get benefit of your direct investment. In case of lump-sum investment, it’s advisable to go direct mutual fund investment only.

Direct Plan in Mutual Funds are for investors who are looking for a little more return and on the same time can manage all the process and research associated with it. If that sounds something like you can manage to do yourself, go for it. Otherwise, choose Regular Plan and take help from an agent who will be more equipped to help you in achieving your investment needs. We personally recommend our user to use Zerodha Coin platform for Direct Mutual Fund Investment.

If you like what you have read and want to choose Zerodha Coin or any other broker, leave your contact information with us and we will guide you.

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account