FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

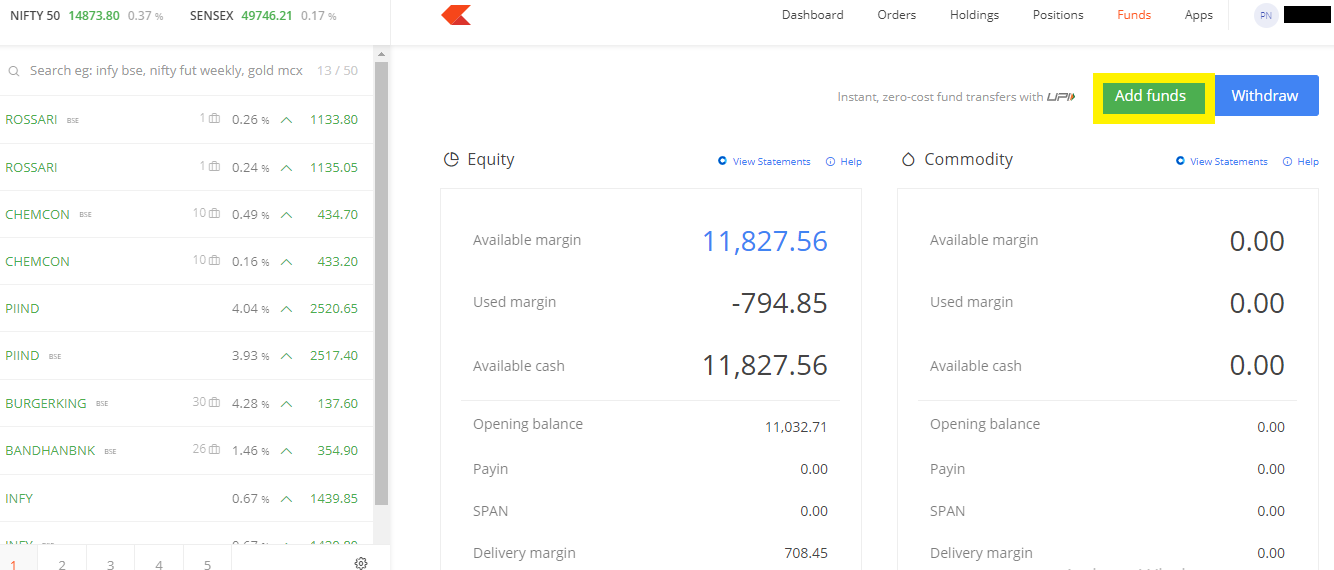

In March 2018, Zerodha launched a Unified Payment Interface (UPI) enabled fund transfer facility. It is the most convenient method to add money from the linked bank account to the Zerodha trading account instantly. The discount broker allows free UPI-based fund transfer up to the daily limit of Rs. 1 lakh at zero charges. Check out Zerodha UPI fund transfer process, features, charges, limit, and more.

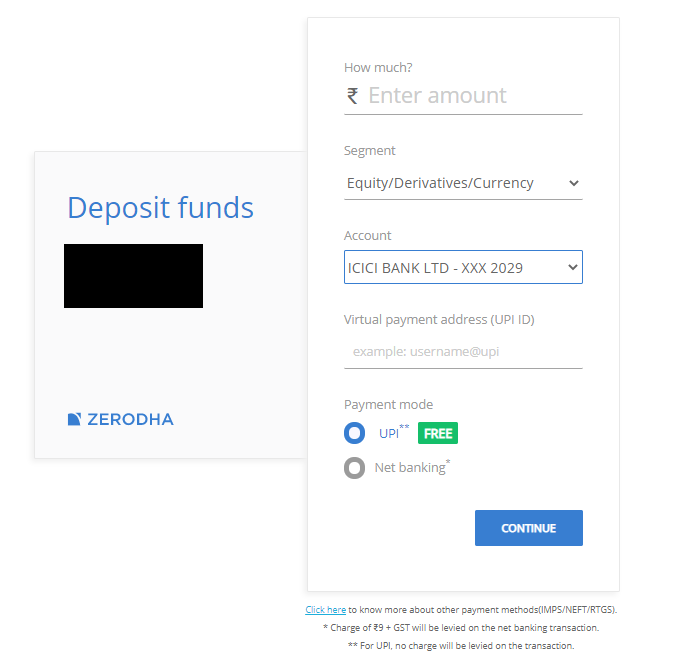

UPI is an instant payment mechanism developed by the National Payment Corporation of India (NPCI) that allows users to instantly transfer funds between two parties bank accounts. Zerodha customers can create a UPI ID on any BHIM UPI app and add funds to their Zerodha account using the linked bank account. Google Pay, Phone Pe, etc. UPI ID can be used to add funds to the Zerodha trading account.

To add money using UPI, all you need to have is a registered UPI ID that must be linked with the same mapped bank account in your trading account. Zerodha Kite (web and mobile app) platform allows UPI-enabled fund transfers (Deposit and withdrawal).

You can use any UPI like PhonePe, Paytm, Google Pay, etc. to transfer money to your Zerodha account.

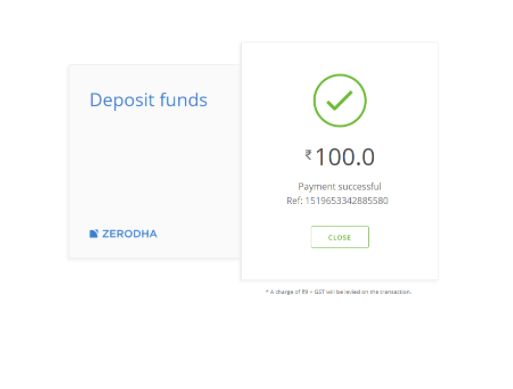

Free, yes, you heard it right, adding funds to the Zerodha trading account using UPI is free for all clients as they are not charged any brokerage fee. UPI transfers funds instantly and it immediately reflects into your Zerodha account.

The fund transfer limit through UPI is Rs. 1 Lakh means customers can transfer a maximum of Rs. 1 lakh per day. However, one can add a maximum of Rs. 25000 for each transaction.

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

Yes, Zerodha Kite mobile app also allows users to add money instantly to your account through UPI at their fingertips. Here is the step by step guide to add funds using UPI on the Kite App:

BHIM / UPI ID is a unique identifier (like email id) created by you which is mapped to your bank account and can be used to send or receive payments in BHIM / UPI system. For exampe - abc@hdfcbank where "abc" is a unique name.

Usually the maximum limit per transaction is Rs 1 lakh and the maximum per day limit is also Rs 1 lakh (subject to change). Do check with your bank for the limits.

There are multiple reasons behind Zerodha UPI payment failure, here are a few:

No, users cannot add funds directly using BHIM UPI App to the trading account. All the fund's payment requests can be placed only through the Kite web and mobile app and then the request needs to be accepted by the user.

Yes, Zerodha facilitates its customers to add funds to their trading account through the UPI payment gateway. Users just need to create a UPI ID on BHIM UPI App and go to the Add funds user interface on Kite to add funds to your account. The best part is that it allows free fund transfer using UPI on your mobile phone.

How to add money to Zerodha Account using UPI

No, adding money to the Zerodha trading account through UPI is free and charged with nil brokerage. A client can transfer up to 25k per transaction restricted to a maximum daily limit of Rs. 1 Lakh.

One must have a registered UPI ID to add money in Zerodha and it must be linked or mapped with the same bank account. The process to create or set up BHIM UPI ID is as follows: