FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

| Price range | 9MFY22 | FY21 | FY20 |

| At or below Rs 1049 | 37.92% | 46.00% | 46.80% |

| Rs 1049-Rs 1499 | 21.29% | 21.13% | 27.98% |

| At or above Rs 1500 | 27.98% | 27.98% | 25.09% |

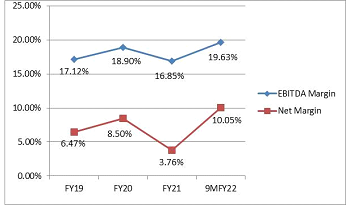

Campus posted total revenues of Rs 843.95 crore for 9MFY22 and posted PAT of Rs 84.80 crore.Strong EBITDA margin and net margins of 19.63% and 10.05 % can be seen from the table for the same corresponding period. The margins have risen significantly due to the effect of rise in sales volume and increase in selling prices.

The turnover for FY21 reduced by 2.5% to Rs 715.08 crore from Rs 734.12 crore for FY20 due to the pandemic. However, one can see that revenues and profitability show an increasing trend in all the last three years except the pandemic affected FY21. Campus posted strong EBITDA margins of 19.63%, 16.85% and 18.90% for 9MFY22, FY21 and FY20 respectively(Refer the chart showing trend in profitability margins).

Return on net worth was 21.07%, 6.67% and 19.95% for 9MFY22, FY21 and FY20 respectively. Return on Capital employed was 18.54 as on FY21 (21% in FY20) but it rose to 21.39% to pre covid levels.

| Particulars | 9MFY22 | FY2021 | FY2020 | FY2019 |

| Total Revenue | 843.95 | 715.08 | 734.12 | 596.7 |

| Revenues from operation | 841.84 | 711.28 | 732.04 | 594.87 |

| PAT | 84.8 | 26.86 | 62.37 | 38.60 |

| EBITDA | 165.22 | 119.82 | 138.33 | 101.87 |

| Total Assets | 884.69 | 684.75 | 719.22 | 505.55 |

| EBITDA Margin | 19.63% | 16.85% | 18.90% | 17.12% |

| Net Margin | 10.05% | 3.76% | 8.50% | 6.47% |

The IPO is priced at 77.66x with annualized EPS of 3.76 for 9MFY22 at upper price band of 292 per share. The sector P/E is 110.51 thus the Issue appears to be fully priced. The listed peers of Campus are Bata and Relaxo Footwear as per the RHP. The business model of these listed peers differs as Bata and Relaxo have multiple product offerings whereas Campus is focused only on athleisure brand in India. Liberty and Mirza International which are also listed also offer athleisure footwear. The Issuer faces competition from international peers like Adidas, Puma, Reebok, Nike, and Decathlon among others in athleisure segment.

| Particulars | Bata India Ltd | Relaxo Footwear | Liberty | Mirza | Campus |

| Face Value | 5 | 1 | 10 | 2 | 5 |

| Total Income for FY21 (Cr) | 1802.57 | 2381.92 | 458 | 1048 | 715.1 |

| EPS (FY21) | -6.95 | 11.74 | 0.14 | 0.69 | 0.88 |

| NAV per share | 136.79 | 63.29 | 109.38 | 53.06 | 10.29 |

| Return on net worth | -5.08% | 18.54% | 0.13% | 1.30% | 8.60% |

| P/E | -202.33 | 74.65 | 908.21 | 66.01 | NA |

| P/B | 10.27 | 13.81 | 1.48 | 0.86 | NA |

| Market Price | 1913 | 1109.7 | 162.3 | 211.75 | NA |

CampusIPO opens on 26thApr- 28th Apr 2022 with a price band of 278-292 per share. Retail quota is 35% and investors can apply with minimum bid of 51 shares (Rs 14,892). Maximum lot size is 663 shares (Rs 1,93,596).The issue is entirely an offer for sale by promoters, TPG Growth, QRG Enterprises. Promoter’s post IPO holding would be 74% from 78% pre IPO holding. The Issue is expected to list on 9th May 2022.

Sports and athleisure is the fastest growing category in both apparel and footwear, growing at a CAGR of approximately 15%. Activities such as yoga, home workouts, running for marathons, walking have gained wider acceptance leading to increase in sales of related products like running shoes, walking shoes, work out apparel, yoga pants etc.

Sports and athleisure footwear is highly under penetrated in India and Campus had an approximately 15% share of the branded sports and athleisure footwear retail market in India by value in FY20, which increased to approximately 17% share in FY21.

Campus is one of the few established Indian athleisure brand with almost 90% of its revenue from this category. Since this segment has been dominated by the international brands such as Adidas, Nike and other international brands, Campus has an opportunity to grow as it scales its operations. The financial profile of the Issuer is strong with increasing trend in its financial metrics and valuation appears to be fully priced. Hence looking at all these factors, one may apply to this IPO.

Review By CA Priyanka Choudhary on 19th Apr 2022

About CA Priyanka Choudhary

Priyanka Choudhary Jain is a Chartered Accountant and an experienced credit analyst. She has worked with CRISIL as Senior Credit Analyst on ratings assignments including business and financial analysis in Corporates as well as the Public Finance Sector.

Email: [email protected]

DISCLAIMER: No financial information whatsoever published anywhere here should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for educational and information purposes only and under no circumstances should be used for making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at own risk. Investors should bear in mind that any investment in stock markets are subject to unpredictable market related risks. Above information is based on RHP and other documents available as of date coupled with market perception. Author has no plans to invest in this offer.