FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

According to new updates by SEBI, it is now mandatory for all IPOs to be supported by UPI 2.0. So now investors can directly apply in IPOs from the broker’s site.

Zerodha has taken a quick reaction on the new opportunity to integrate UPI payment gateway with online IPO application. Zerodha is now facilitating its clients to apply in IPOs using their back-office dashboard Console and UPI ID.

Steps to apply in IPOs using UPI and Zerodha Console (back-office platform) :

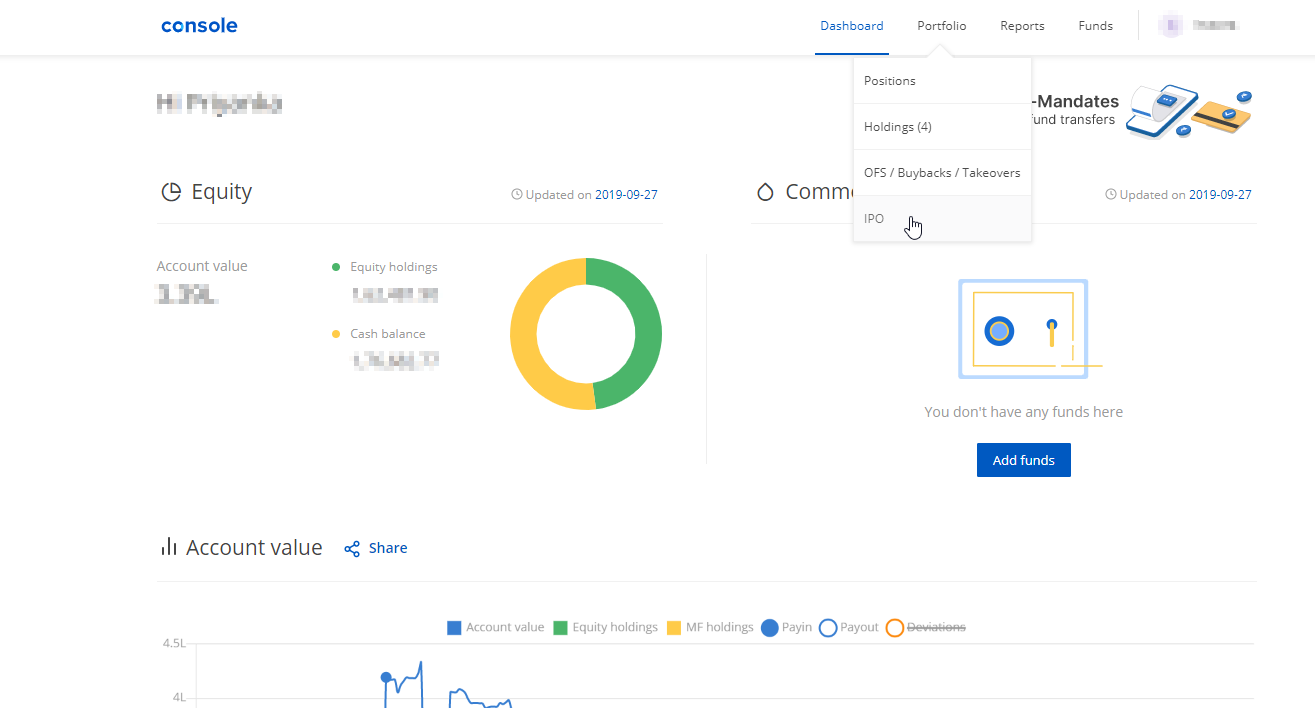

Login to Console and select ‘IPO’ in the ‘Portfolio’ menu.

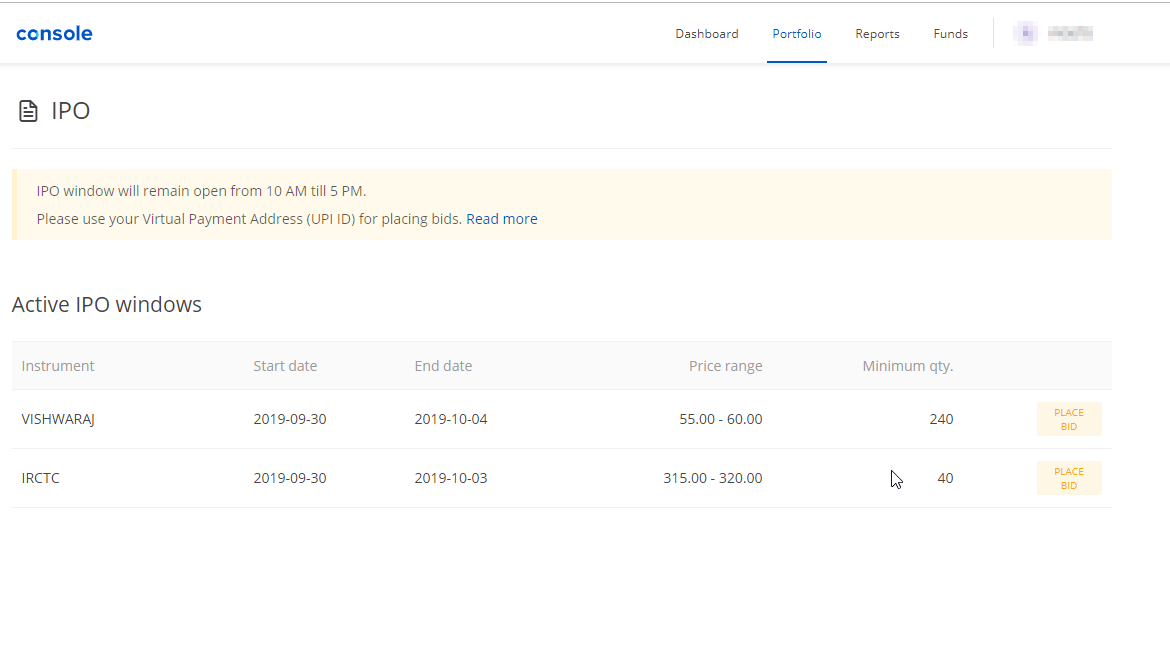

Select the IPO you want to apply for from the list of open issues.

Check the details of the offer, like open date, close date, issue size, lot size, and DRHP for the IPO selected.

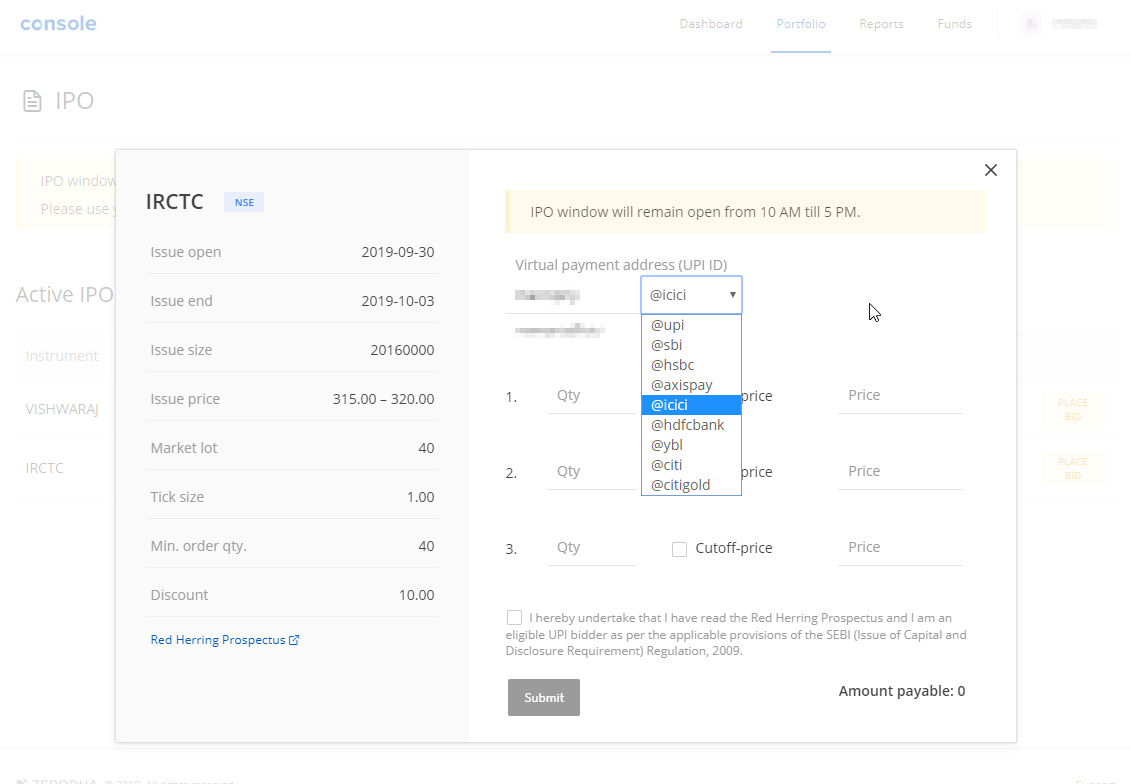

Enter your UPI ID linked to your bank account.

Place your bid(s) only in the multiples of lot size.

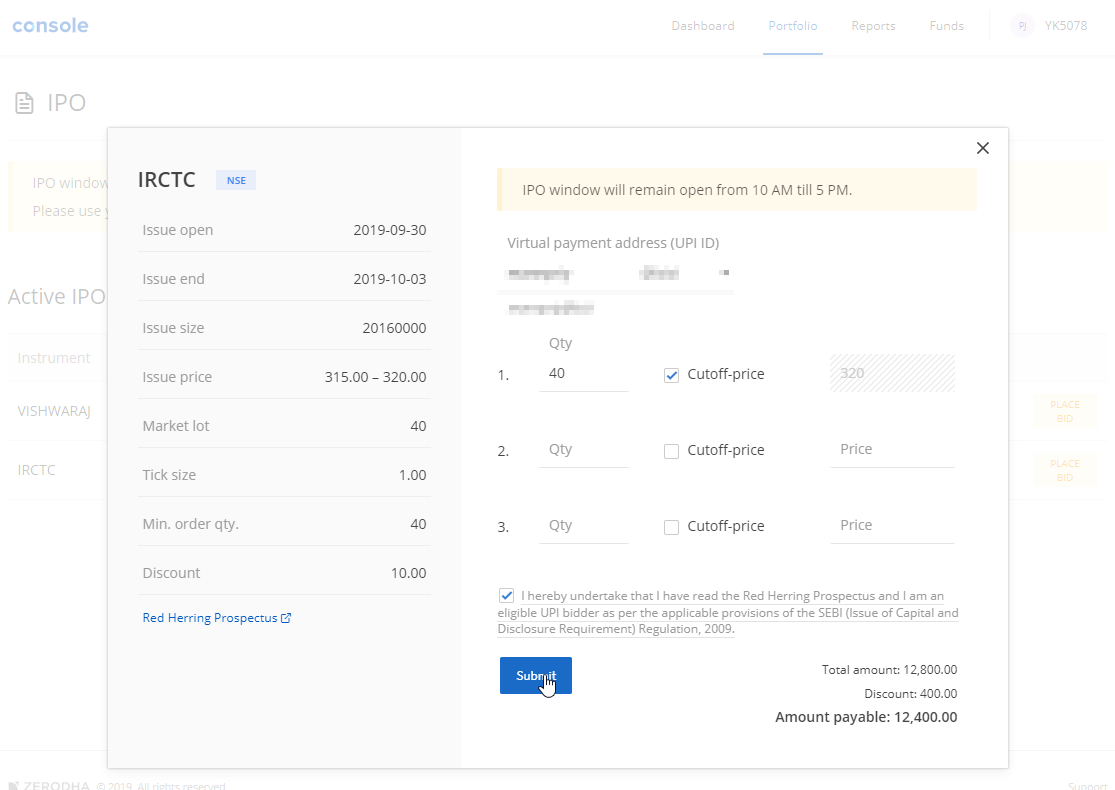

Now click on the checkbox for the cut-off price, if you wish to apply at the cut-off price.

For placing a bid at any other price, enter a price in the ‘Price’ field.

Check the agreement at the end and submit.

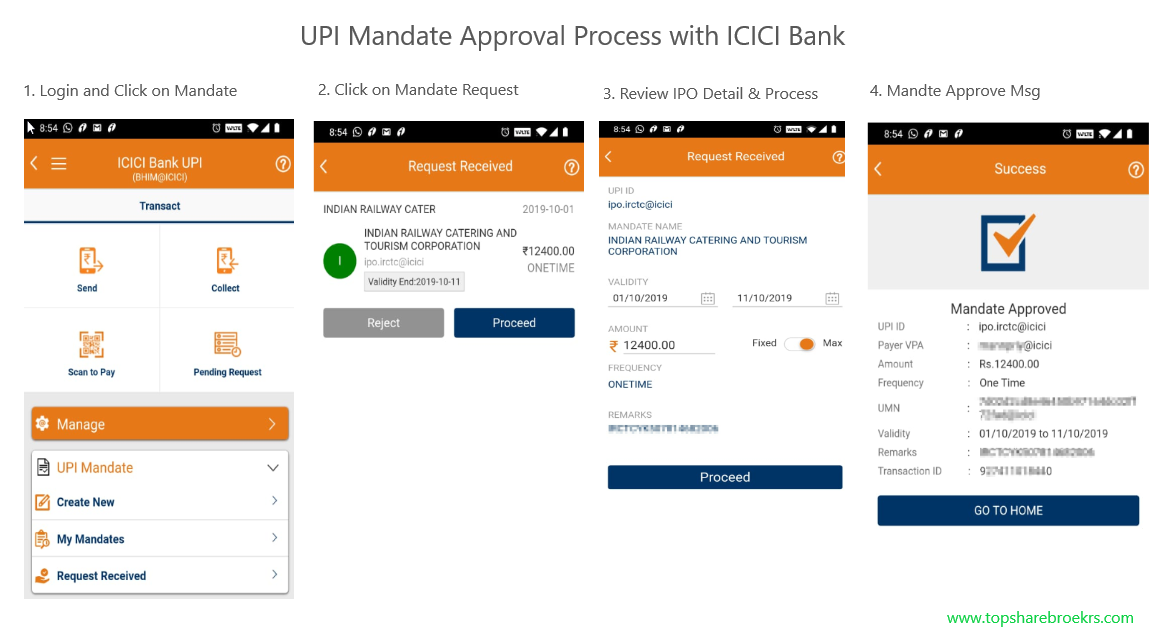

Next, you will receive a mandate request on your UPI app in few hours.

Accept the mandate. This will block the funds required for the application in your bank account until the date of allotment (2 days before the listing date).

If you receive an allotment, the money is debited from your bank account and shares are credited to your demat account.

If you don’t receive an allotment, the blocked funds are released on the date of allotment.

Zerodha Trade@20

List of all questions Ask your question