FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

Zerodha is the Depository Participant (DP) with CDSL to allow customers to open a Demat account online. The demat account opening charge at Zerodha is Free while demat account maintenance charge (AMC) is Rs 300 PA charged on a quarterly basis (in every 3 months). Looking to open a demat and trading account with India’s largest broker, check out the Zerodha Demat charges including account opening charges & Annual Maintenance Charges (AMC), transaction charges, Demat and Remat charges, pledge charges, failed Instruction charges and other charges.

| Transaction | Charges |

|---|---|

| Trading Account Opening Charges | Online Rs 200 (Eq+Curr), Rs 300 (Eq+Curr+Com) |

| Trading AMC | Free |

| Demat Account Opening Charges | Free |

| Demat AMC | Rs 300 PA |

| # | Type | Details |

|---|---|---|

| 1. | DP Source | CDSL |

| 2. | Demat Account Annual Maintenance Charges(AMC) | ₹300 pa |

| 3. | Statutory Charges (Stamp Charges payable upfront) | ₹50 |

| 4. | Advance Deposit | Nil |

| 5. | Transaction Charges (Market Trades) | |

| Buy (Receive) | ₹ 0 | |

| Sell (Debit) | ₹8 + ₹5.50 (CDSL Charges) per transaction | |

| 6. | Demat & Remat Charges | |

| Demat | ₹150 per certificate + ₹100 courier charges | |

| Remat | ₹150 per certificate + ₹100 courier charges + CDSL Charges | |

| 7. | Pledge Charges | |

| Pledge Creation | ₹20 + ₹12 CSDL charges | |

| Pledge Creation Confirmation | Nil | |

| Pledge Closure | ₹20 + ₹12 CSDL charges | |

| Pledge Closure Confirmation | Nil | |

| Pledge Invocation | ₹20 | |

| 8. | Failed Instruction Charges | ₹50 per instraction |

| 9. | Other Charges Demat | Nil |

| 10 | Remarks | Nil |

Zerodha charges the Account Maintenance charge (AMC) quarterly instead of annually. The AMC charge is “0” if your account is a BSDA account (Basic Service Demat Account). For the BSDA account, the condition is you need to have only one Demat account and the holding value, including stocks, mutual funds, and bonds should be less than 2 lakhs.

For the Non-BSDA account, the AMC charge is as below.

| Account type | Quarterly Charges | Per Year |

|---|---|---|

| Individuals, HUFs, and partnership firms | Rs 75 | Rs 300 |

| NRIs | Rs 125 | Rs 500 |

| Corporate, i.e. LLPs and private & public companies | Rs 250 | Rs 1000 |

* 18% GST on all ablove given charges.

Zerodha provides CDSL Demat account. So if you want to transfer shares from another broker to Zerodha there are two different methods.

In the DIS slip, you have to fill in your Zerodha Demat details and the shares you want to transfer.

Zerodha is a Depository Participant with the CDSL depository. It’s a member of CDSL and provides CDSL Demat accounts.

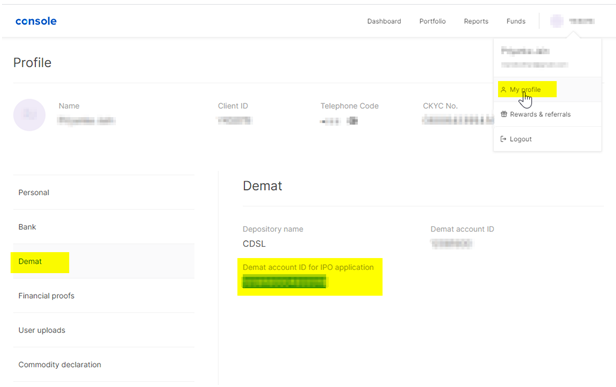

You can check your account DP details in the console Account section.

Your Demat account number will be the DP ID followed by the Beneficiary ID. Follow these steps to find your Zerodha Demat account number;

The Demat ID is a 16digit number, a combination of DP id and followed by BO id. This is unique for every client and is asked while applying IPOs or Rights issues.

DP id is the same for all Zerodha clients as either 12081600 or 12081601. But the 8-digit BO id(Beneficiary Owner Identification Number) is different for every client and sometimes it is also called the Client id.

Your Depository Participant(DP) name is Zerodha Broking Limited.

The AMC (Account Maintenance charge) is deducted once every quarter by Zerodha. The total AMC charge is 300 Rs +18%GST per year. Zerodha deducts this quarterly as 75 Rs+18%GST in every 90days from the date of account opening.

Zerodha doesn’t charge any AMC for BSDA accounts.

The Auto-square off time varies for different segments. If you have taken any trade in MIS/Intraday and didn’t square off before the square-off time, Zerodha might charge you an auto-square-off charge of 50 Rs +18%GST.

The square-off time for different segments is as mentioned below.

| SEGMENTS | Square-off time |

| EQUITY | 3.20 PM |

| Futures and Options | 3.25 PM |

| Currency Derivatives | 4.45 PM |

| Commodities | 25 Mins before Market closes |

The DP charge in Zerodha is taken as 13.5 Rs +18% GST per scrip sold. DP charge is charged by Depository CDSL and Depository participant (Zerodha) jointly. This is charged only while selling the share out of your equity holding and not charged for equity intraday trades or for any other segments.