FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

In 2018, Zerodha has partnered with Thomson Reuters (TR), a multinational research company, and launched the Stockreports+ platform to offer the comprehensive market, industry, and stocks research reports of 3000+ companies. Any Zerodha client can subscribe to the Stockreports+ and check industry rankings, industry & sectoral analysis, access stocks fundamental as well as technical research reports, and view the proprietary rating for stocks to make better investment decisions. Scroll down the page further to know more about Zerodha Stockreports+ charges, features, Stockreports+ web, login process, pros, and cons.

Stockreports+ has a number of features, listed here as under:

Stockreports+ has 3 different pricing plans for varied time duration i.e. one month, 6 months, and one year. Clients are free to choose any of the subscription plans as per their preference.

| Stockreports Plus Charges | |

| Monthly Plan | Rs. 150/month |

| 6 Months | Rs. 810/6 months or Rs.135/month |

| 1 year | Rs. 1,440/year or Rs. 120/month |

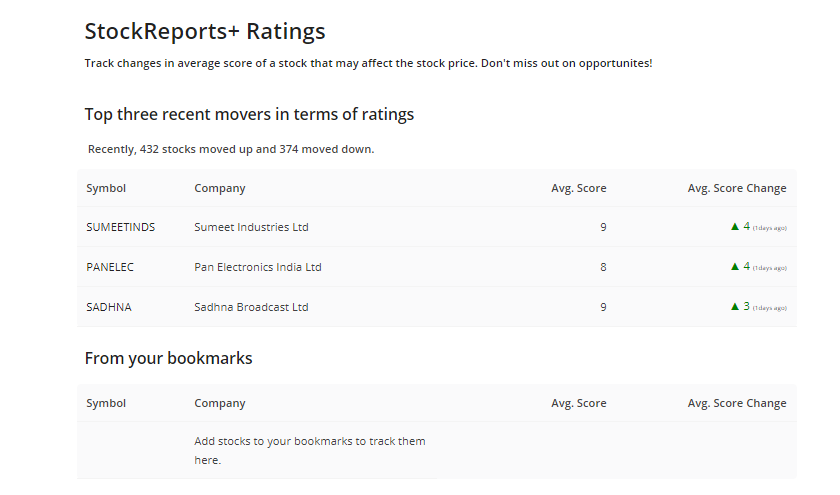

Stockreports+ platform provides proprietary rating features to rate stocks based on different aspects like earnings, fundamentals, relative valuations, risks, and price momentum. Users can even track changes in the stock rating (Average score and average score changes) to check whether changes are positive or negative based upon the last update.

Stocksreports+ doesn’t require any separate login ID credentials as users can simply log in to the Zerodha Stockreports+ using his Kite login credentials i.e. user name and password.

Stockreports+ platform is only available in the web version and the mobile app for the platform is not yet launched. Customers can access the stockreports.zerodha.com in any supported browsers i.e. Chrome, Safari, Internet Explorer etc.

| Pros/Advantages | Cons/Disadvantages |

|---|---|

|

|

Despite being a discount broking firm, Zerodha still provides stock research reports to customers on Stockreports+ to serve them in the best manner. No peers in the discount broking space offer research services to their clientele base. Despite knowing the fact that Zerodha Stockreports+ is a paid platform but its services i.e. comprehensive market, industry, and equity reports, fundamental and technical researches, stocks rating based on fundamentals, valuations, risks, etc. and its changes helps traders and investors a lot and justifies the nominal chargeable subscription fee.

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

Zerodha as a discount broker doesn't have a research team. However, Zerodha has a collaboration with Thomson Reuters to provide Equity research to Zerodha customers as paid service. Zerodha clients can review Thomson Reuters StockReports+ platform @Rs 150 PM plan or Rs 810 Half Yearly Plan or Rs 1440 Yearly plan.

StockReports+ has around 3000 Indian stocks updated daily, their rating, Industry ranking, Industry & sectoral analysis, comprehensive insights like earnings, fundamentals, risk, price movement, and insider trading.

StockReports+ is not a 100% research tool. It is more of an analytical platform that tells you the current fundamentals of the company and future outlook of the company and ranks accordingly.

No, research report on Stockreports+ is not free as customers have to pay a subscription fee to access the report. Zerodha has three different Stockreports+ subscription plans based on different time duration.

Zerodha Stockreports+ Subscription plans:

In Sep 2018, Zerodha has launched Stockreports+ platform to provide comprehensive stock reports on over 3,000+ Indian Stocks to its clients. The platform was introduced by partnering with Thomson Reuters whose research reports are available on Stockreports.zerodha.com.

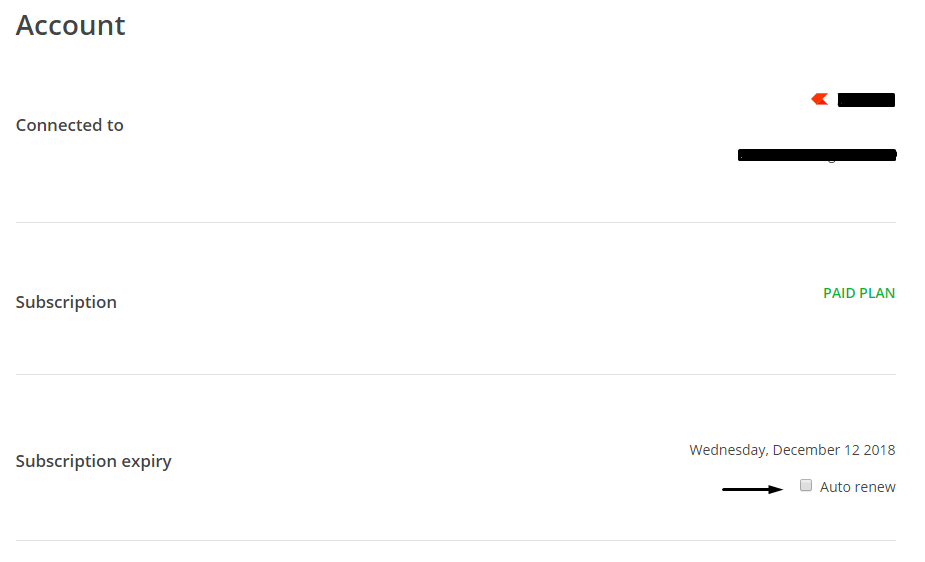

You cannot cancel your existing Stockreports+ subscription in Zerodha, however, you are allowed to stop auto-renew of your subscription to Stockreports+. To do this, you just need to uncheck the Auto-renew field.

Any Zerodha client can get stock research reports, access fundamental and technical researches, and view the proprietary ratings for a number of stocks by subscribing to the Stockreports+.

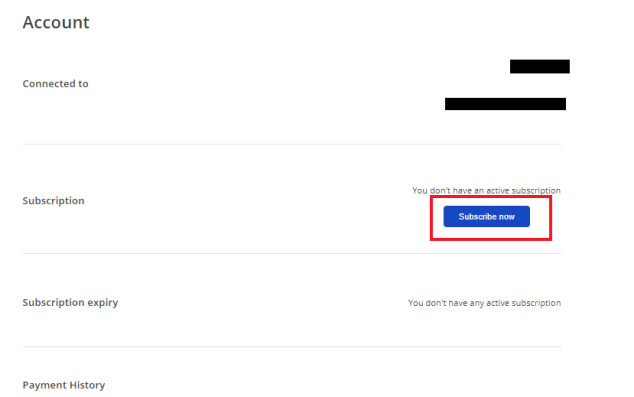

Steps to subscribe to the Zerodha Stockreports+:

| Analyst Score | This rating is based on the 3 components; earning surprise, estimate revision, and broker recommendations changes. |

| Fundamental Score | Stock fundamental is ranked upon considering profitability, debt, earnings quality, and dividend. |

| Risk Score | Risk for every stock is rated based on long-term and short-term stock performance i.e. returns, beta, volatility, and correlation. |

| Tech Score | Two technical factors i.e. relative strength and seasonality are considered to rate tech score to stocks. |

| Relative Valuation Score | Valuation scoring is done based on 3 key components i.e. price to sales, trailing P/E, and forward P/E. The rating helps users to find out that whether stock is available at a cheaper or expensive valuation. |

| Average Score and changes | Stock average score is done based on all the above ratings i.e. analyst score, fundamental score, risk score, tech score, and relative valuation score. |