FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

In 2016, Zerodha has partnered with a fin-tech company “Smallcase” to launch “Zerodha Smallcase” a thematic investment product. Smallcase Zerodha referred to as “Invest in ideas” is a platform to allow investors to invest in a basket of stocks from a particular sector, theme, or investment idea.

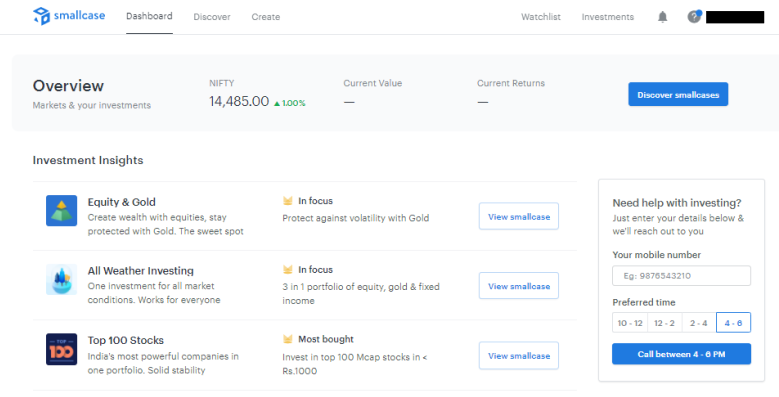

it is a great investment product to invest in a group of stocks together and thereby build a diversified, low-cost, and long-term portfolio. Currently, there are 50+ themes available on Smallcase such as All Weather Investing, Rising Rural Demand, Electric Mobility, Safe Haven, Quality - Smart Beta, etc. Customers are free to invest in any of the ready-made thematic portfolios based on their future perception, or they can even create a customized portfolio.

Smallcase for Zerodha platform is available in the web as well as mobile app versions. On this page, get the complete review about how Zerodha Smallcase works, charges, features, login, smallcase screener, Smallcase mobile app, and more.

As said earlier, smallcase is a thematic investing portfolio to invest in a basket of stocks from a particular theme. Let’s take an example of “Electric Mobility” smallcase, now the reason behind creating the theme is that currently, the Indian government aims to promote the use and manufacturing of electric vehicles. So, it ultimately drives demand for the particular segment, so anyone who thinks that the electric vehicle segment can perform exceptionally well in the upcoming years, then, instead of investing in one or two stocks, can invest in “Electric Mobility” smallcase to put his money in a diversified portfolio of stocks from that particular sector to reduce risk. There are 50+ themes available on Smallcase, among which, users can select their favorite theme and undertake investment.

Smallcase Zerodha follows a flat fee structure and by charging a flat fee of Rs. 100+ GST per smallcase regardless of the value of the investment. For instance, suppose if a client invests Rs. 100,000 and Rs. 50,000 in 2 different smallcase then in total, he would be charged with Rs. 200.

In 2018, Zerodha has introduced an all-new Smallcase 2.0 platform, a simpler, faster, and feature-rich modern thematic investment platform. Check out the important features of Smallcase 2.0 as follows;

Smallcase is integrated with the most powerful and comprehensive ticker tape stock screener, a stock discovery tool to filter stocks on various parameters i.e. future estimates, broker ratings, ownership structure, profitability, and financial ratios, etc. There are 70+ filters and in-built screeners available on ticker tape to enable users to find the best stock under their choice of investment theme or idea.

There are 2 pricing plans for Screener, one is a free plan and another is Screener Pro plan (paid version) to unlock premium filters and export CSV file. Zerodha provides 14 days free trial of the Pro version and later, charges will be applicable as per the timeline selected. Here are the details:

Smallcase mobile app is available to facilitate users to invest in a curated ready-made thematic portfolio or in your own customized portfolio. The mobile app enables users to invest in a multiple numbers of stocks on a single click and online portfolio tracking and monitoring anytime anywhere. The Smallcase app is available on the Play Store and the App Store.

To access smallcase, you must open a Zerodha trading account and use your Zerodha account user ID and password to log in to the Smallcase platform. Check out the Zerodha smallcase web and app login process explained here as under:

| Zerodha smallcase customer support number | 080 4718 1888 |

| Zerodha smallcase customer-care e-mail | [email protected] |

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

Smallcase is a professionally managed portfolio/basket of stocks that reflects an investment strategy, idea, or theme. There are a number of themes available on the Zerodha Smallcase platform, users are allowed to choose the particular theme of their interest and undertake investment in the preferred theme.

No, investing in smallcase with Zerodha is not free. Zerodha levies Rs. 100 flat brokerage to invest in smallcase with Zerodha. However, investment in All Weather Investing or Smart Beta smallcase is completely free but if you placed other orders like investing more, rebalancing, SIP, then charges of Rs. 50 + GST applicable will be levied.

Smallcase is an equity investment product based on thematic investing and portfolio-based investing. Thus, it is a bunch of several stocks based on an investment idea or theme such as all-weather investing, rural demand, etc.

Steps to invest in smallcase with Zerodha;

Yes, Smallcase Zerodha allows SIP (Systematic Investment Plan) as well as one-time (lumpsum) investment. Small retail investors or beginners are advised to start SIP to make fixed regular investment periodically for long-term to get attractive returns.

Yes, Smallcase is the best platform to invest in a diversified, low-cost, long-term portfolio based on a particular theme, idea, or sector.

Anytime, whenever you want, you can sell your investment in smallcase. Here is the process to sell Zerodha smallcase;

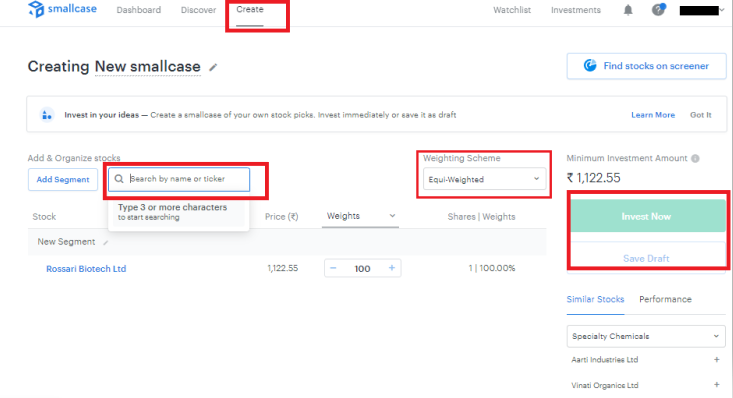

Customers can either invest in a readymade smallcase portfolio or can create their own portfolio by selecting stocks. Here are the steps to create a customized portfolio in smallcase;