FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

Zerodha is the first broker to launch a free direct mutual fund investment platform, "Zerodha Coin". It is the best platform to invest in direct mutual funds for free at zero commission or brokerage. The platform also facilitates investment in Govt securities (T-bills), corporate bonds, ETFs, and sovereign gold bonds (SGB).

Coin Zerodha platform is available in the web and mobile app versions. You can access coin.zerodha.com web through any compatible browser or download the coin mobile app on Android and iOS.

Walkthrough with the complete Zerodha Coin review including coin mutual fund brokerage charges, coin app features, login process, Coin for NRI, and pros & cons.

Nil, yes, Zerodha coin is a free platform to facilitate users to invest in direct mutual funds at zero brokerage. Coin is not just a free direct MF investment platform but also facilitates zero-cost redemption w.e.f. May 3, 2019.

Although earlier, the brokerage firm was charging Rs. 50 every month but later in August 2018, the broker made the Coin Zerodha platform completely free.

There are multiple reasons to invest in mutual funds with the Zerodha coin. Here are the details;

Coin by Zerodha is the best platform for investment in direct mutual funds for free and in a hassle-free manner. The platform has thousands of equity, debt, hybrid, and ELSS tax-saving schemes of over 40 mutual fund houses. You can select any scheme of your choice and start SIP or invest lumpsum.

Zerodha has the single Kite login credentials to access all of the platforms i.e. Coin, Console, Streak, etc. You can use Kite's user ID and password to log in to the Coin. Steps to login to the Coin app:

You can withdraw funds from mutual funds by placing fund redemption request anytime online. Coin for Zerodha allows zero brokerage redemption facility at 0 charges.

Zerodha Mutual Fund Redemption Charges: Nil, Free redemption. In May 2019, Zerodha completely removed the Rs. 5.5 DP charges on mutual funds redemption.

The cut-off timing in mutual fund decides the applicable NAV to your mutual fund purchase and sells transactions. Check below the coin Zerodha cut-off time for different schemes;

| Scheme type | MF Purchase/Buy Transaction | MF Redemption |

| Liquid and Overnight Fund | 12:00 PM | 1:30 PM |

| Other schemes (Equity, Debt, and Hybrid) | 1:30 PM | 1:30 PM |

For liquid and overnight schemes, any mutual fund investment order placed before the cut-off time will be executed at T-1 day’s NAV. For other schemes, buy or sell transactions placed before the cut-off timing will be executed at T day’s NAV. While orders are placed after the cut-off time, the next day’s NAV will be applicable.

No, NRIs having a PIS account (Portfolio Investment Scheme) cannot invest in mutual funds on Coin. However, they are allowed to buy direct funds through a non-PIS NRI account. US and Canada-based investors cannot buy mutual funds through Coin by Zerodha platform.

Zerodha provides Coin platform in web as well as a mobile app versions. Coin app provides flexibility to users to buy direct mutual funds anytime anywhere with just a few clicks. Coin Zerodha app is available on the Google Play Store (Android) and the App Store (iOS).

| Pros/Advantages | Cons/Disadvantages |

|---|---|

|

|

| Zerodha Coin Customer Care helpline number | 91-8047181888 |

| Zerodha Coin Customer Support | Raise a ticket |

Coin Zerodha came as a game-changer in the mutual fund industry with no subscription charges or free unlimited investment in direct mutual funds. Unlike regular plans where investors have to pay hefty commission charges, there’re no such requirements on the coin which ultimately provides investors great returns. Further, a plethora of schemes available, easy portfolio tracking, hassle-free investment on fingertips on the coin app, free redemptions, etc. evident Zerodha Coin as the best platform for Mutual Fund Investment.

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account

Describe the difference between Direct and Regular Mutual Funds?

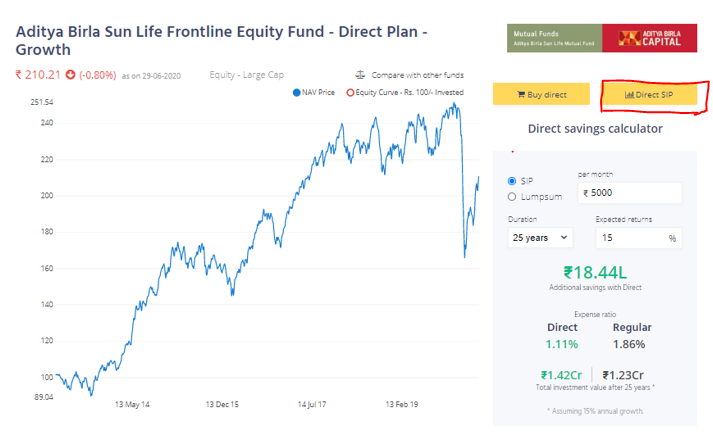

On the behest of SEBI in 2013, it was made mandatory for the Asset Management Companies to offer Direct Mutual Funds in which investors can invest in the scheme without involving any brokers, agents or distributors. This resulted in the non-payment of any commission to the aforementioned entities.

From that period, the convoluted process of Mutual Funds was bifurcated into Regular & Direct Plans.

Being an investor, you can select the investment scheme according to your financial requirements, i.e., Regular or/and Direct Plan. Both plans seem identical: your money will be invested in the same fund, managed by the same fund manager, the fund will have the same risk. So, what's the difference between direct and regular mutual funds?

The critical difference is of the intermediary involved in both schemes.

Reliance Money Manager fund with regular plan having expenses .55%, rated 2 stars and return since launch is 8.37% as of April 14th 2017 by valueresearchonline.

Where Reliance Money Manager fund with direct plan having expenses .23% rated 3 stars and return since launch is 9.13% as of April 14th 2017 by valueresearchonline.

In Regular plans, distributor charges commission of 1.5% (Approx), upfront, and 1%(Approx) every year from your investments. This commission will start from day one of your investment until you redeem your complete investment. So if you are SIP investor investing every month, then you are paying a very big amount as commission to your distributor.

Coin is an excellent platform for investment in mutual funds due to the following reasons:

Zerodha offers Coin as a free service to the investors. The investors can invest in more than 40+ AMCs in Direct mutual fund schemes and manage a single login for all your mutual fund investment.

In this cut-throat competition, none of the other brokers are providing this free facility. Considering the operations of other brokers in the market, they provide a Free Mutual Fund Account for investment in Regular Plans with them, for which the investor has to pay huge commissions. The broker gets an extra commission paid by the investors as the reward from AMC.

If you want to save the broker's commission then the direct mutual fund is the only solution for you.

Yes, Zerodha Coin is India’s safest mutual funds platform as all the mutual fund units bought through coin are credited to the Zerodha Demat Account with CDSL. Hence, your MF investment in direct plans will be kept safe and secure.

Zerodha Coin app provides multiple search filter options to customers to search for the right scheme in line with their risk appetite and investment goal. There are the following filters available on the Coin app;

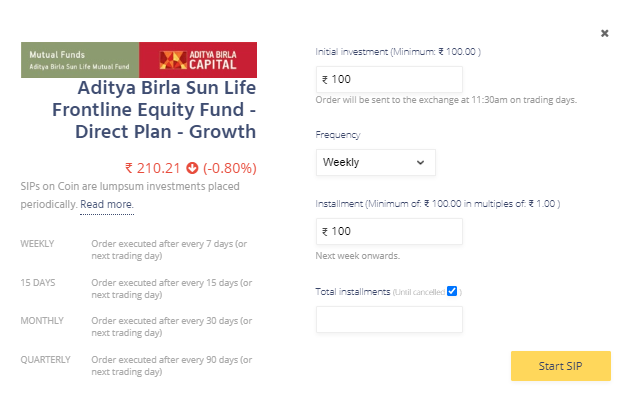

Investors can choose from various buying options for Mutual Fund. Such as one-time investment (lump sum payment) or systematic investment plan SIP.

SIP or systematic investing plan is when you invest small periodical amounts instead of lump sums. On the Zerodha MF platform, you can start as many SIPs as you want with a click of a button without having to sign any mandate forms.

Nil, Yes likewise free mutual funds investment, Zerodha facilitates customers to sell mutual funds holdings from their Demat account at ₹0 DP charges. Earlier, the broker was charging ₹5.5 DP charges but thereafter, in May 2019, the broker has removed the DP charges and started offering free redemption facility.

Zerodha Coin has a number of advantages while considering the other brokers in this industry:

If you have opened a DEMAT account with Zerodha, automatically, your Coin application will be activated.

For all those investors, you have been with Zerodha before September 15, 2015, their DEMAT account would be with IL&FS.

Firstly, the investors are required to close their DEMAT account with IL&FS. And then, apply for the Zerodha DEMAT account to initiate the working of Zerodha Coin.

Coin for Zerodha mobile app allows easy and hassle-free online mutual funds investment and redemption/withdrawal at 0 charges.

Steps to withdraw money from Zerodha Coin App:

Yes, you need a demat and trading account with Zerodha to undertake investment in mutual funds via coin. Zerodha coin is a free mutual funds platform to invest in direct plans at zero commission. The said platform is only accessible by Zerodha users thus, even if you’ve demat and trading account with any other broker then you won’t be able to invest in mutual funds on Coin.

Yes, Zerodha Coin is a 100% free mutual funds investment platform that neither charges any brokerage from customers on MF investment nor it charges DP Charges on redemption. If you are the one looking to buy direct plans then undoubtedly, Zerodha Coin is the best platform to invest in thousands of schemes from 40+ big fund houses.

Coin for Zerodha is the best platform for hassle-free direct mutual funds investment process at nil charges. Check out the process to purchase mutual funds through Coin;

Zerodha Coin is the country’s largest direct mutual fund investment platform that enables users to buy direct funds online from asset management companies without any commission. You can invest in mutual funds with Zerodha coin on either the Coin web platform or the coin mobile app available on Google play store and the App Store.

Anyone who want to invest in direct mutual funds through Coin doesn’t need to open coin account. Users just need to open Zerodha Demat Account and access to Zerodha Coin will be available to them to undertake direct MF investment for free. Users can use the Kite user ID and password to activate to the coin Zerodha.

Yes, Zerodha provides Coin mobile app to allow them to buy mutual funds at their fingertips. Coin app provides the flexibility to users to purchase SIP or lumpsum in mutual funds anytime anywhere on just a few clicks using their mobile phone. Android users can install the app from the Play Store and iOS fanatics (iPhone, iPad) can download it from the App Store.

Conditional orders are similar to limit orders in stocks which means placing buy or sell mutual funds orders at a specified NAV, therefore, also termed as “NAV-Tracking” orders. These orders can only be placed for the lumpsum investment and not allowed for SIP investment.

Steps to place Conditional Order in lumpsum MF investment;