FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

At last, the wait is over for the largest IPO in the Indian Capital Markets. LIC IPO opens on 4th May and closes on 9th May 2022. The Centre has made the offer lucrative by giving a discount of Rs 45 to LIC employees and retail quota and it is pegged at Rs 60 per share for the policyholders. The government is now divesting 3.5% of its share in LIC amounting to Rs 21000 crore as against 5% which amounted to Rs 70,000 crore planned earlier. Thus, it has bought down the valuations in the light of current market scenario due to Russia Ukraine war. Let's see in detail if the valuations are attractive also!

| Particulars | 9MFY22 | FY2021 | FY2020 | FY2019 |

| Total Income | 512279.21 | 703709.45 | 645605.47 | 570809.57 |

| Net Premium Earned | 285341.93 | 405398.50 | 382475.52 | 339971.63 |

| Income from Investments | 226253.73 | 285520.42 | 242836.31 | 225043.54 |

| Other Income | 683.54 | 12790.54 | 20293.64 | 5794.40 |

| Total Assets | 884.69 | 684.75 | 719.22 | 505.55 |

| EBITDA | 1756.97 | 2980.35 | 2718.52 | 2642.37 |

| PAT | 1715.31 | 2974.14 | 2710.48 | 2627.38 |

| Share capital | 6325.00 | 100.00 | 100.00 | 100.00 |

| Reserves | 2498.62 | 6705.47 | 891.66 | 798.44 |

| EPS | 2.71 | 4.70 | 4.29 | 4.15 |

| RoNW | 20.84% | 45.65% | 317.14% | 322.25% |

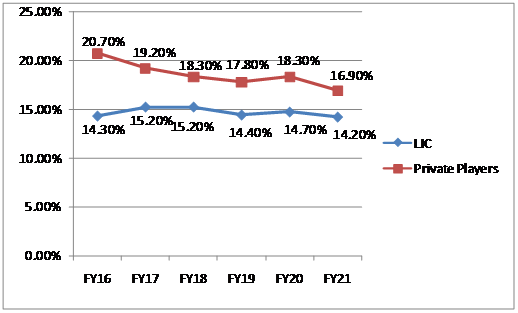

One can refer the key financial measures from the table. Other than those above, new business premium is also an important factor that would determine the future prospects. LIC continues to dominate the group NBP segment with 78% market share for FY21. However, market share for individual NBP for private players has been increasing over the years to 57% against 43% for LIC during 9MFY22.

VNB (Value of new Business) Margin for LIC is low being 9.30% (9.90% for FY21) during 6MFY21 while VNB margin was 27.4%for HDFC Life for FY22.

The share Capital of the Issuer increased to Rs 6325 crore as at the end of 9MFY22 due to the issue of Bonus shares in Sept 21 against the free reserves.

With valuations at around Rs 6,00,000 crore and Embedded value (EV) being Rs 5,40,000 crore, IPO is valued at 1.1x its EV. Private listed peers like HDFC life, SBI life and ICICI Pru, they are currently priced at 4.05x, 3.10x and 2.49x to their EV. Hence LIC is lucratively priced at these valuations when compared to its domestic peers. However, international peers like Ping An Insurance, China Life Insurance are priced at 0.54x and 0.21x respectively.

However, it should be noted that EV is sensitive to equity changes in the market.

| Particulars | SBI Life Insurance | HDFC Life Insurance | ICICI Pru | LIC |

| Face Value | 10 | 10 | 10 | 10 |

| Total Income for FY21 (Cr) | ||||

| Net Profit | 1455.85 | 1360.87 | 956.16 | 2974.14 |

| EPS (FY21) | 14.56 | 6.74 | 6.66 | 4.70 |

| NAV per share | 103.99 | 42.75 | 63.51 | 10.30 |

| Return on net worth | 14.00% | 15.75% | 10.48% | 45.65% |

| P/E | 78.16 | 82.33 | 78.81 | NA |

| Share Price (29th Apr 2022) | 1125.10 | 593.45 | 535.30 | NA |

| Market Price | 3.10 | 4.05 | 2.49 | NA |

The insurance stocks rallied recently as they reported strong financial numbers than expected in the last quarter of FY22. HDFC Life and SBI Life appreciated 4% while ICICI Pru rose by 3% on 28th April 2022. It is seen that the insurance stocks are currently trading at a discount to their past valuations and these valuations are favourable to arouse investor interest. LIC IPO has further bought the insurance sector in limelight with foreign investors' attention.

The insurance sector is highly underpenetrated in India and the pandemic has all the more spread the awareness for insurance.

LIC is the oldest and the largest insurance company of India, it is the most trusted insurance brand which cannot be replicated. LIC has a presence across India through its omnichannel distribution of agents. The Issuer is also the largest asset manager in India with an established track record of financial performance and profitable growth.

However, entry of private players into the insurance sector has resulted in market share being distributed across all the players. Private players have began using technologies like blockchain that may radically transform operations by providing benefits in the form of reduced costs, enhanced customer experiences, improved productivity, increased transparency, fraud prevention and more. The corporation in the long run would have to introduce these changes along with innovation in its product mix to enhance its profitability and VNB margins to compete effectively.

The management highlighted that there are good margins on non par products (LIC's margin on non par products is quite high at 80%) and if their strategy to bring more non pan products goes well, VNB margins would also improve.

The Issuer is likely to grow at 15-20% for the next two three years in terms of premium and 10-12% in terms of policies as per the management. LIC has tied up with Policybazar as a step towards pushing the products through digital channel as well.

Considering all the factors and reasonable valuations with discounts in the price band for retail quota, one might Apply for Long Term in the IPO.

This IPO analysis focuses on what makes LIC different from the private players in the insurance industry and understand the comparable key metrics vis a vis the private players. The rationale also discusses the persistency ratio used to analyse the insurance business and how the embedded valuation of LIC.

LIC was formed by merging and nationalizing 245 private life insurance companies in India on September 1, 1956, with an initial capital of Rs50.00 million. LIC was the only life insurer in India until the year 2000. LIC has its branch in Fiji, Mauritius and the United Kingdom and subsidiaries in Bahrain (with operations in Qatar, Kuwait, Oman and the United Arab Emirates), Bangladesh, Nepal, Singapore and Sri Lanka.

| Market share - H1FY22 | Total Premium | New Business Premium | Renewal Premium | No. of policies -Individual | No. of policies -Group |

| LIC Life | 63.60% | 64.50% | 62.90% | 70.90% | 84.30% |

| SBI Life | 7.90% | 7.80% | 8.00% | 7.40% | 0.70% |

| HDFC Life | 6.60% | 7.90% | 5.50% | 3.90% | 0.50% |

| ICICI Prudential | 5.60% | 4.90% | 6.20% | 2.80% | 5.60% |

| Max Life | 3.00% | 2.40% | 3.50% | 2.50% | 0.20% |

| Bajaj Allianz | 2.20% | 2.70% | 1.70% | 1.80% | 0.60% |

| Others | 11.20% | 9.90% | 12.20% | 10.70% | 8.20% |

| Private Players Total | 36.40% | 35.50% | 37.10% | 29.10% | 15.70% |

As seen in the table below; Non-linked products constituted 99.7% of LIC’s portfolio in FY21. None of the private players amongst the peers reported more than 70% of its premium through non-linked products. It is implied that the ULIP portfolio of all life players witnesses some downturn in demand when the capital market cycle is not favourable.

During FY20 all private players witnessed substantial downturn in premium from linked products due to downturn in capital. LIC has a strong focus on traditional non-linked products where demand is not linked to market cycles. While having a pre-dominantly non-linked product portfolio makes LIC’s premium income less susceptible to volatility in equity markets but however it lowers the yield on its investment side.

| Product Mix based on total premium | Linked | Non Linked | Participating (within non linked) | Non Participating (within non linked) |

| LIC Life | 0.30% | 99.70% | 60.90% | 39.10% |

| SBI Life | 56.60% | 43.40% | 34.90% | 65.10% |

| HDFC Life | 29.10% | 70.90% | 28.00% | 72.00% |

| ICICI Prudential | 63.40% | 36.60% | 35.20% | 64.80% |

| Max Life | 30.90% | 69.10% | 59.80% | 40.20% |

| Bajaj Allianz | 36.40% | 63.60% | 36.60% | 63.40% |

| Channel Mix | Individual agents | Corporate Agents- Banks | Corporate Agents- others | Direct Business | Others |

| LIC Life | 93.80% | 3.10% | 0.10% | 2.20% | 0.80% |

| SBI Life | 27.70% | 65.40% | 2.80% | 4.10% | NA |

| HDFC Life | 12.30% | 45.80% | 3.80% | 32.90% | 5.20% |

| ICICI Prudential | 24.70% | 46.80% | 5% | 17.10% | 6.30% |

| Max Life | 26.20% | 63.50% | 1.80% | 8.30% | 0.20% |

| Bajaj Allianz | 41.60% | 32.20% | 2.40% | 12.40% | 8.30% |

Persistency Ratio is the proportion of policyholders who continue to pay their renewal premium. Persistency ratio is an important benchmark for life insurers as it reflects the number of policyholders who paid their renewal premium. It is widely seen as an indicator of the quality of the sale as well as future growth.

The 13th month persistency measures the renewal premium paid by the policyholder at the commencement of the second year. Similarly, the 37th-month persistency and 61st-month persistency indicate the percentage of policyholders who choose to continue their policies at the end of the third and fifth year. The persistency ratio disclosed by life insurers considers both the number of policies by count and premiums that continue with them. Persistency ratio is lowest in the initial years when compared with other private insurers and highest in 61st month.

| Persistency Ratio | 13th Month | 25th Month | 37 Month | 49 Month | 61 Month |

| LIC Life | 78.80 | 70.90 | 67.60 | 64.80 | 60.60 |

| SBI Life | 84.50 | 76.40 | 72.00 | 67.30 | 49.70 |

| HDFC Life | 85.90 | 75.70 | 66.00 | 62.80 | 52.30 |

| ICICI Prudential | 85.00 | 75.00 | 66.30 | 60.00 | 51.80 |

| Max Life | 84.00 | 67.00 | 60.00 | 55.00 | 50.00 |

| Bajaj Allianz | 81.10 | 72.30 | 64.70 | 58.80 | 45.30 |

Embedded value (EV) is the sum of the net asset value (adjusted net worth) and present value of future profits of a life insurance company. This measure considers future profits from existing business only, and ignores the possibility of introduction of new policies and hence profits from those are not taken into account.

LIC’s Indian Embedded Value (IEV) has increased significantly from Rs 9,560 crore as at 31st Mar 21 to Rs 53,968 crore. This is because of increase in shareholders funds to 100% in non participating funds which resulted in transfer of large part of equity to non participating funds thereby increasing Marked to Market (MTM) of LIC’s equity book. Hence marked to market equity gains have contributed to massive increase in EV. Refer the below table for clarification:

Recent Regulatory Changes in the LIC Act

There has been change in the surplus distribution policy of LIC as explained below:

Earlier- LIC maintained only one pooled fund called the Life Fund. Surpluses allocated were 95% for policyholders and 5% for shareholders i.e. the Government of India.

Now- Govt amended the LIC act to bifurcate single policyholder funds to create two separate funds- participating funds (for participating policies) and non participating funds (for non participating policies) and surpluses from non-participating funds was100% allocated to shareholders. Hence this had a significant rise in MTM equity gains which shored up the EV.

Abu Dhabi Investment Authority, Singapore based GIC, three Canadian pension funds and Qatar Investment Authority among other sovereign wealth funds and pension funds could be the anchor investors of the IPO.

Review By CA Priyanka Choudhary on

About CA Priyanka Choudhary

Priyanka Choudhary Jain is a Chartered Accountant and an experienced credit analyst. She has worked with CRISIL as Senior Credit Analyst on ratings assignments including business and financial analysis in Corporates as well as the Public Finance Sector.

Email: [email protected]

DISCLAIMER: No financial information whatsoever published anywhere here should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is purely for educational and information purposes only and under no circumstances should be used for making investment decisions. Readers must consult a qualified financial advisor prior to making any actual investment decisions, based on information published here. Any reader taking decisions based on any information published here does so entirely at own risk. Investors should bear in mind that any investment in stock markets are subject to unpredictable market related risks. Above information is based on RHP and other documents available as of date coupled with market perception. Author has no plans to invest in this offer.