FREE Equity Delivery and MF

Flat ₹20/trade Intra-day/F&O

Zerodha Trade@20

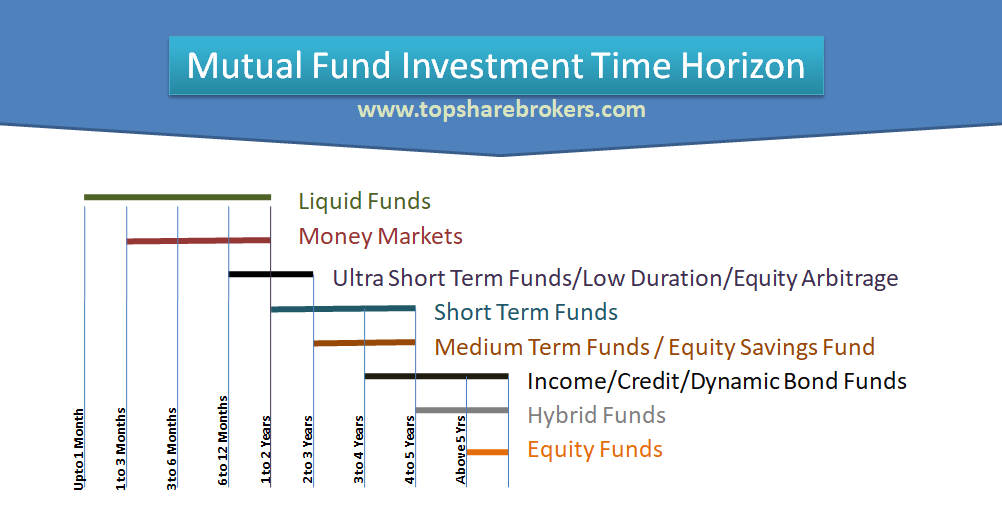

Choosing the Right Investment Horizon for Your Mutual Fund

Mutual funds are very convenient tools to tap the potential of financial markets. They open avenues to investment which otherwise would be difficult to access. For instance, you would be spending a lot more money to add 30 or 40 stocks to your portfolio than you would by investing in an equity mutual fund which will provide you access to these many stocks via a single fund.

Though a mutual fund is a simple and effective choice for your investment needs, there are still some aspects to be mindful of when investing in the security. We will be looking one of those aspects in this article: Investment horizon.

One of the mistakes that you can make while investing in a mutual fund even after choosing an appropriate fund is investing in it for either too long or too short a duration. A mis-timed investment is as detrimental to an investment portfolio as a poorly chosen fund. Let’s look at the appropriate investment horizon for a particular fund category, as well as those periods which are poor or sub-optimal choices.

In this article we have presented timeline guide for best return of your investment by mutual fund category. Summary is presented in table and in-depth details are discussed later.

| Time Horizon Mutual Fund Scheme |

Upto 1 Month | 1 to 3 Months | 3 to 6 Months | 6 to 12 Months | 12 to 24 Months | 24 to 36 Months | 36 to 48 Months | 48 to 60 Months | Above 5 Years |

|---|---|---|---|---|---|---|---|---|---|

| Liquid Funds | |||||||||

| Money Markets | |||||||||

| Ultra Short Term Funds | |||||||||

| Low Duration | |||||||||

| Equity Arbitrage | |||||||||

| Short Term Funds | |||||||||

| Medium Term Funds | |||||||||

| Equity Savings Funds | |||||||||

| Income/Credit/Dynamic Bond Funds | |||||||||

| Hybrid Funds | |||||||||

| Equity Funds |

![]() Wrong Choice

Wrong Choice ![]() Right Choice

Right Choice ![]() Sub Optimal Choice

Sub Optimal Choice ![]() Tactical

Tactical

This is a popular category among mutual fund investors, but it also the most poorly invested one in terms of the investment horizon. The appropriate investment horizon for equity funds is 5 years and above. You can also choose to invest in these funds for a period of 4 to 5 years for tactical purposes.

A tactical investment strategy is used to shift the percentage of holdings in various categories to take advantage of market pricing and strong performing sectors. For example, if a sector is expected to perform well over the medium-term, you can invest in that sector for less than 5 years for tactical purposes. But generally, diversified and multi-cap funds should be invested in for 5 years or above. For any period from a month to less than 4 years, investing in equity funds in a not a great choice.

A hybrid fund allocates its assets across equity and fixed income investment classes in various proportions. It aims to generate capital in the long run via the equity portion and generate income in the short run via the fixed income portion. If you are not the one who can take high risks on a long-term basis but still want to invest in equities, hybrid funds are for you. Depending on the risk handling capacity, you can choose the proportion of equity and fixed income that you would be comfortable with and there will be a fund which can help you invest in that manner. Because of this feature, hybrid funds are sometimes also referred to as asset allocation funds.

The appropriate investment horizon in hybrid funds in 4 years and above. For those trying to ride an equity wave or those who have a high exposure to equities, a tactical investment can be made ranging from 3 to 4 years. If you are a moderate risk capacity investor but want to benefit from a particular equity tide, you can use hybrid funds to increase exposure to equities for 3 to 4 years. Meanwhile, if you already have a lot of exposure to equities and want to balance that out, you can use hybrid funds for the same duration to alter the allocation of your portfolio.

Income funds aim to create regular income for investors by investing in bonds (both government and corporate), certificate of deposits, debenture, etc. Some funds may invest a small portion of the portfolio in high dividend generating stocks as well. Credit risk funds try to generate income by investing in lower rated corporate bonds. Meanwhile, dynamic bond funds shift allocation between short and long duration bonds.

If you are investing in any of the above funds, the investment horizon to consider is 3 years and above. Anything lower and you expose yourself to interest rate risk, credit risk, and sometimes, even liquidity risk.

Equity savings funds aim to strike a balancing act between risk and returns by investing in equities, derivatives and fixed income instruments. Conducting arbitrage trades is a key feature of this fund type as it is aimed at rescuing the chances of decline in portfolio returns. An equity savings fund is a great tool for a conservative investor who does not want to take too much risk.

The right investment horizon for this fund type is 2 to 4 years. Anything less is making the wrong choice because it is too less a time for the equity component to function properly. Anything more, on the other hand, makes it a sub-optimal choice because it is better to go for a hybrid fund than an equity savings fund if you are interested in making a longer-term investment.

In terms of investment horizon, the same holds true for Medium Term Funds (which are fixed income-oriented) as well – 2 to 4 years is the right choice; anything longer will make it sub-optimal for a portfolio. It is better to choose an income, credit or dynamic bond fund over a medium-term fund if you wish to stay invested for longer than 4 years.

The purpose of short term funds is to park your money in short term fixed income instruments like commercial papers, certificates of deposit and bonds to navigate the prevailing interest rate environment. The ideal investment horizon for these funds is 1 to 3 years, with a maximum of 4 years. A lower horizon is not advisable because of the nature of fixed income securities these funds invest in. If the horizon is over 2 years, you can also consider medium term funds as an alternative to these funds.

An equity arbitrage fund is different from other equity oriented mutual funds. Rather than investing in stocks for long term capital appreciation, it focuses on benefiting from the price difference in stock between spot and futures markets. These funds can invest a large portion of their assets in fixed income instruments and are suited for low risk taking investors.

Because arbitrage opportunities may not come up very frequently, investing in this fund for the long haul is not advisable. A period of 6 months to 2 years is the optimal horizon for arbitrage funds.

Both low duration and ultra short term funds invest in debt instruments with a short maturity. They are named so for a reason – their ideal investment horizon is 6 months to 2 years. They are essentially used to park excess money for which you may not have a definite purpose in the near term. For a longer investment horizon toward debt instruments, investors can look at short and medium term funds.

Money market funds invest in debt instruments which are very close to their maturity. These are used mainly to stop money from lying idle and earn higher interest than a savings bank account. The appropriate investment horizon for these funds starts from 1 to 3 months and can go up to a maximum of a year.

Liquid funds have the shortest investment horizon, which can start from a few days lasting up to a month. A maximum of 6 months to a year is advised for these funds. Even at this stage, you may consider investing in a money market or ultra short term fund instead of a liquid fund.

Want to start your investment journey, join India’s Pioneer Discount Broker – ZERODHA – Free Delivery Trade, Maximum Rs 20 for F&O and Intraday, Free Direct Mutual Fund investment.Open Zerodha Account